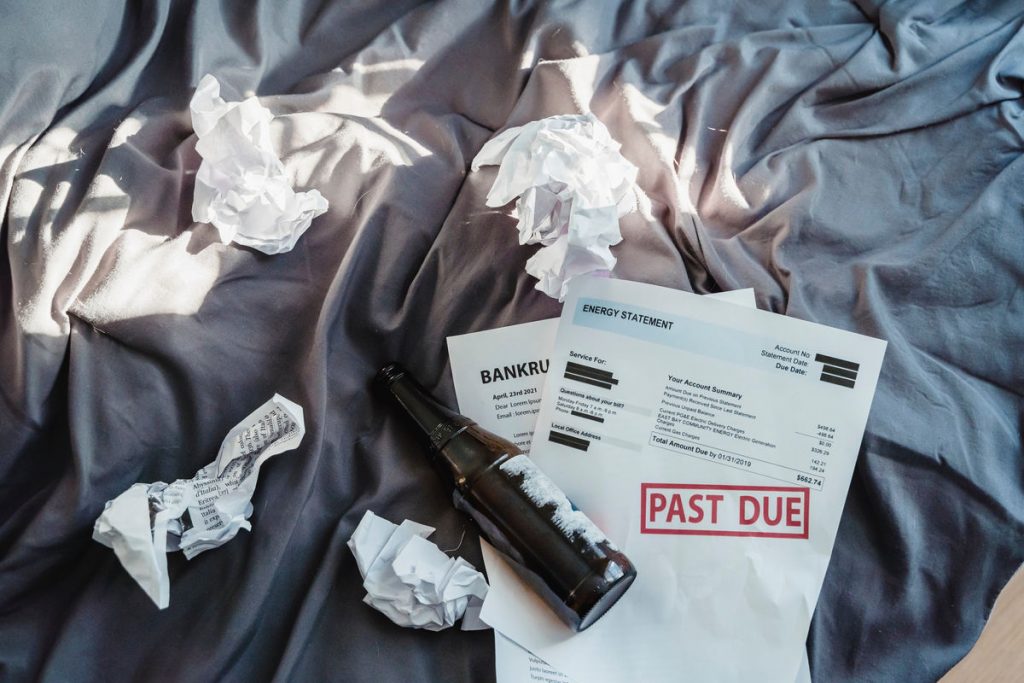

Businesses need to generate revenue to survive. If a business does not make a profit for an extended period, the business owners may need to go into bankruptcy or close the business. They may also look at different ways to re-organize the business. Here are five reasons to file for bankruptcy.

1. Increased Competition

Increased competition can shrink the profits that a business gets. Competition can be a good thing as it helps a business adjust and keep growing. However, direct competition can shrink the pie. If a business doesn’t come up with better quality products, or they do not come up with cheaper manufacturing processes, they end up losing customers and losing business.

If consumers cannot differentiate between your goods and that of the competitors, then you do not have a competitive advantage to stay afloat. You can avoid this challenge by making your products or services stand out. If you fail to do that, competitors may kick you out of business.

2. General Business Challenges

There are so many challenges that may affect how a business runs. A business may suffer management issues, problems with location, and demographic shifts that can affect a business. These factors can slowly or quickly affect a business’ viability. Businesses may also have a challenge recruiting or retaining top talent, which means that innovation challenges catch up with them.

Today, businesses that do not move with technology miss out on opportunities. Technology keeps changing and businesses that do not have experts to help them stay on top of new technologies are phased out. With technology comes terabytes of data that businesses have to deal with. If you are not able to handle that data, you end up missing out on business opportunities.

3. Lawsuits

Lawsuits tarnish the reputation of a business. The reputation of a business is important, and while it takes several years to build, it can crash within a few minutes. Businesses try as much as possible to settle disputes without litigation. A business can go for arbitration, direct negotiations, mediation, and other such methods that do not involve the public.

When that fails and the cases go to court, a business suffers major drawbacks. For starters, lawsuits can drain a business’s finances, time, energy, and emotions. Small businesses with meager operating budgets will be wiped out within a few months. The lawsuits will also create a rift between parties and sever relationships.

Customers will be hesitant to do business with your company after a lawsuit. What happens when you declare bankruptcy? Your assets will go towards paying your debts, and you will be out of business. You can avoid these lawsuits by working with a lawyer to find better ways to solve problems.

4. Regulatory Changes

Changes in regulations and legislation can affect how a business operates. These changes cause rippling effects in industries. Because businesses must abide by these new regulations, those that are unable to adapt will be phased out.

A change in policies can result in increased cost of operations, introduce business administrative hurdles, and can even restrict business operations. Different regulations affect different businesses. For instance, changes in tariffs and international trade policies affect businesses that do imports and exports. American businesses in China faces several trade restrictions as they cannot invest in Chinese stocks and can only operate in China through a partnership or a joint venture.

Tax policy reforms, minimum wage laws, sick days and vacation days, and financial regulations can also affect how a business operates. The regulatory agencies either create new regulations or update the old ones.

5. Taxation

Can a government tax a business to bankruptcy? If your business’ tax structure is off, you might end up paying more than you should. Your business might end up with tax debt, debts owed to lawyers and consultants, and so much more. You can ensure your business files for tax when needed and in a way that allows you to make huge tax savings. If you have a problem, with your business tax structure, you should seek the help of a professional before the tax drives your business into bankruptcy.

Any of the factors above can force a business into bankruptcy. If your business suffers two or more of these factors, then you may have to file for bankruptcy sooner than later.