How do corporate taxes for small businesses vary around the world?

As global trade becomes more interdependent, countries have increasingly used corporate

tax rates as a way to attract international business and support domestic economic activity.

However, given the numerous ways that different countries apply corporate tax, it can be

difficult to compare nations at a glance.

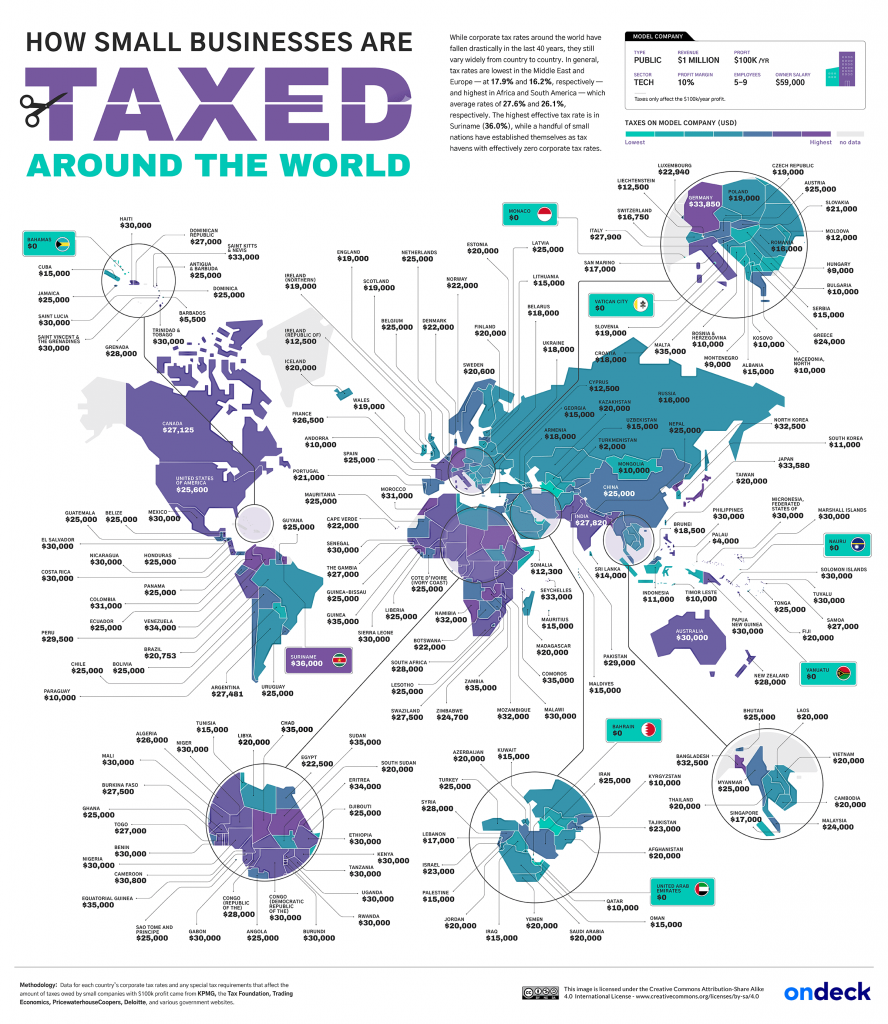

To determine how small businesses are taxed around the world, OnDeck reviewed corporate

tax rates and special corporate tax requirements for small companies in 200 countries. The

team then applied the rules for each country to the same example company (set revenue,

size, profit, employer base etc.) as a reference point.

Here’s a preview of the world map showing the tax rates around the globe:

Credit Information: Credit should go to OnDeck with a link back to the original source of the

content: https://www.ondeck.com/resources/how-small-businesses-taxed-every-country

Methodology

Data for each country’s corporate tax rates and any special tax requirements that affect the

amount of taxes owed by small companies came from KPMG, the Tax Foundation, Trading

Economics, PricewaterhouseCoopers, Deloitte, and various government websites.

To better understand the costs of doing business around the world, OnDeck applied each

country’s tax laws to a model company with revenue of $1 million, profit of $100,000 a year,

five to nine employees, is owned by a resident of the country in question, and earns a

majority of its revenue from business operations within the country in question.

The study doesn’t include companies in the oil, gas, and mining sectors or publicly traded

companies.

The full data can be found here: https://bit.ly/HowSmallBusinessesAreTaxed

Available Assets

OnDeck produced a series of assets:

1. World Map: detailing the cost of tax for the example business [image]2. Continent Maps: closer look at each continent of the cost of tax for the example

business, including pull-out stats for key countries

? Europe [image]? North America [image]? South America [image]? Middle East & Central Asia [image]? Rest of Asia & Oceania [image]? Africa [image]3. HTML Table: Filterable HTML with effective tax rate and amount taxed (embed code

in Dropbox Transfer link)

Key Findings

? Tax rates are lowest in the Middle East and Europe — at 17.9% and 16.2%,

respectively.

? They are highest in Africa and South America –– with average rates of 27.6% and

26.1%, respectively.

? The highest effective tax rate is in Suriname (36.0%).

? A handful of small nations have established themselves as tax havens with

effectively zero corporate tax rates — Bahamas, Bahrain, Monaco, Nauru, United

Arab Emirates, Vanuatu, and Vatican City.

Research Notes

How Small Businesses Are Taxed in Europe

On average, small businesses in Europe face a corporate tax rate of 17.9%, the lowest of any

region other than the Middle East & Central Asia. Europe also excels in other measures of

ease of doing business. It takes an average of 12.7 days to start a new business, and start-up

costs are just 3.2% of GNI per capita — each the smallest such figures of any region.

? Georgia’s 15% general corporate income tax rate is one of the lowest in the world. It

also takes an average of just one day to start a new business, the second shortest

duration of any country.

? Companies in Monaco who earn at least 75% of their revenue within the country are

exempt from corporate tax.

? The 12.5% corporate tax rate in Cyprus is among the lowest in the world. The

country also has the third most new business registrations per capita of any country.

? Companies are subject to a flat corporate income tax rate of 21% in mainland

Portugal, while companies in the archipelagos of Madeira or the Azores are subject

to a corporate income tax rate of 14.7%.

? While Spain levies a general corporate income tax rate of 25%, newly created

companies are taxed at 15% for the first period in which they report a profit, as well

as the following tax period.

How Small Businesses Are Taxed in North America

Corporate taxes vary in North America more than in nearly any other region. While the

Bahamas is regarded as a tax haven, the neighboring islands of Saint Kitts and Nevis, Trinidad

and Tobago, Saint Vincent and the Grenadines, and Saint Lucia are home to some of the

highest corporate tax rates in the world.

? While Belize was once considered a tax haven, recent changes to the tax regime have

given the country corporate tax rates similar to the rest of the world.

? In the United States companies are subject to a 21% federal corporate income tax

rate, as well as state corporate taxes — which range from 0% in Washington, Nevada,

Wyoming, South Dakota, Texas, and Ohio to 11.5% in New Jersey.

? Canada levies a net federal tax rate of 15% on corporations, in addition to the

corporate taxes levied by the provinces and territories, which range from 8% in

Alberta to 16% in Prince Edward Island.? While corporate taxes in Canada are close to the global average, it takes an average of just 1.5 days to start a new business in the country — the third shortest period of

any nation.

How Small Businesses Are Taxed in South America

Small businesses in South America face an average corporate tax rate of 26.1%, the highest

of any region other than Africa. The continent ranks low in other measures of business

friendliness. It takes an average of 42.6 days to start a business, and start-up costs are

equivalent to 41.4% of GNI per capita — each the highest such figures of any world region.

? Brazil also levies a surtax of 10% on all annual taxable income over 240,000 Brazilian

reais ($43,474 USD).

? Guyana levies a general 25% corporate income tax rate, as well as a 40% tax rate on

companies that get at least 75% of their gross income from goods they did not

manufacture themselves.

? Venezuela has an effective tax rate of 34%, among the highest in the world.

Additionally, it takes an average of 230 days to start a business, and costs more than

twice the country’s GNI per capita — each the highest such figures of any nation.

How Small Businesses Are Taxed in the Middle East & Central Asia

In the Middle East & Central Asia, the average corporate tax rate is just 16.2% — the lowest

of any world region. But while countries like Bahrain, UAE, Turkmenistan, and Qatar have

effective tax rates ranging from 10% to 0%, they do levy higher taxes on oil and gas

companies. Government revenues from oil and gas operations help keep corporate taxes low

for other sectors in these oil-rich countries.

? While there are no taxes in Bahrain on income, sales, capital gains, or estates, on

limited occasions a 46% tax rate may be levied on the net profits of oil and gas

companies.

? The UAE has designated “free zones” where companies are exempt from corporate

taxes for a period of 15 to 50 years.

? Qatar levies a 10% general corporate tax rate and a rate of at least 35% on oil

companies.

? Kuwait charges an additional 1% zakat on the net profits of all publicly traded

companies.

How Small Businesses Are Taxed in the Rest of Asia & Oceania

Corporate tax rates vary more in the rest of Asia & Oceania more than in any other region.

While the island nations of Nauru and Vanuatu are effective tax havens, countries like Japan,

Bangladesh, and Kiribati have some of the highest corporate tax rates of any country.

Singapore, where the effective corporate tax rate is just 17%, ranks as the second most

business-friendly country overall, according to a World Bank report.

? Laos offers companies using green technology a reduced corporate tax rate.

? The Marshall Islands exempts all non-resident (offshore) companies from corporate

income tax, and levies a 3% tax rate on gross revenue for local resident companies.

? Micronesia levies a 3% corporate income tax on small companies, and a 30%

corporate income tax on larger companies.

? While New Zealand has an average corporate tax rate, it takes an average of just half

a day to start a new business — the shortest time of any country in the world.

How Small Businesses Are Taxed in Africa

Corporate tax rates are generally higher in developing countries. In Africa, the average

corporate tax rate is 27.5% — the highest of any region. Chad, Comoros, Equatorial Guinea,

Guinea, Sudan, and Zambia all tie for the second highest corporate tax rate in the world at

35%. Many countries in the region also rank as the worst for ease of doing business, with

high start-up costs and multiple barriers to entry.

? Mauritius has the second lowest corporate tax rate in Africa (15%), and the most

new business registrations per capita of any country on the continent.

? Tunisia charges companies in the banking, debt collection, telecommunication, car

dealing, and resource extraction sectors more than twice the general corporate tax

rate.

? Companies in Burundi either owe taxes equivalent to 1% of their revenue or 30% of

their profits, whichever is the larger amount.

? Equatorial Guinea’s 35% corporate tax rate is the second highest in the world. It also

takes an estimated 16 procedures to start a new business there, the second most

procedures of any country worldwide.

Sources

The World Bank. (2020). Ease of Doing Business rankings. doingbusiness.org

KPMG. (2021). Corporate Tax Rates Table. home.kpmg

Asen, E. (2020). Corporate Tax Rates around the World, 2020. taxfoundation.org

Trading Economics. List of Countries by Corporate Tax Rate. tradingeconomics.com

PricewaterhouseCoopers. (2021). Worldwide Tax Summaries Online. pwc.com

Deloitte. (2021). Corporate tax and withholding tax rates. deloitte.com

GSL. (n.d.). Tax systems of foreign countries – Monaco. gsl.org

Gardetto Law Offices. (n.d.) Personal Taxation. gardetto-monaco-lawyers.com

Content Team. (2021). Recent key changes in Belize tax law on IBCs. bbcincorp.com

Watson, G. (2021). Combined State and Federal Corporate Income Tax Rates in 2021.

taxfoundation.org

World Bank Group. (2019). Economy Profile, Marshall Islands. doingbusiness.org

Offshore Protection. (2021). Marshall Islands as an Offshore Financial Center.

offshore-protection.com

Deloitte. (2013). Tax and Investment Profile for Micronesia. deloitte.com

East African Community. (n.d.) Income tax – Corporate entities. eac.int

Deloitte. (2019). Guide to fiscal information; Key economies in Africa. deloitte.com

About OnDeck

OnDeck helps small businesses get the funds they need to manage challenges and

opportunities — and succeed on their own terms. The team believes that small businesses

are the lifeblood of the U.S. economy, and historically have been underserved financially.

Since their founding in 2006, they’ve been committed to making it efficient and convenient

for small businesses to access financing online. OnDeck pioneered the use of data analytics

and digital technology to aggregate and analyze thousands of data points to assess the

creditworthiness of small businesses rapidly and accurately. They also created a simple

online application, backed by exceptional customer service – so business owners can get the

funds they need, and back to running their business.

About NeoMam Studios

NeoMam Studios is a creative studio based in the UK on a mission to create digital content

that online audiences will want to share.