When we think of diamonds, we often associate them with luxury, opulence, and sometimes an unattainable price tag. The iconic phrase “diamonds are forever” has ingrained the idea that these […]

Read morePricing for New Businesses: How to Set Prices When You’re Just Starting Out

Introduction: Why Pricing Can Make or Break Your Business One of the most common struggles new business owners face is setting the right price for their products or services. It […]

Read moreSeasonal Merchandising Made Easy: Storage Tips for Retailers

Retail companies face a distinct set of difficulties when it comes to handling their seasonal inventory. Proper seasonal merchandising requires not just successful sales methods, but also smart storage solutions […]

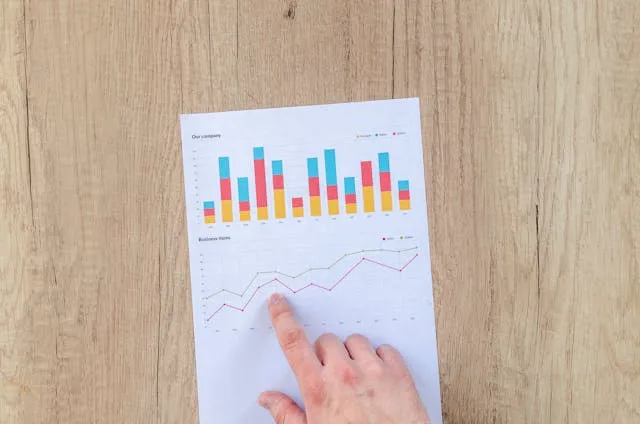

Read moreHow Advanced Computing Is Revolutionizing Financial Modeling

Thanks in great part to major developments in computing technology, financial modeling has changed remarkably recently. Once a subject dominated by simple computations and rudimentary spreadsheets, artificial intelligence, machine learning, […]

Read moreHow Crash Reports Can Help Urban Planners Make Improvements

Urban planning involves designing safer cities that are efficient and livable overall. Planners face a major hurdle in rendering traffic way safer by drastically cutting back on nasty accidents. Crash […]

Read more8 Creative Ways to Boost Your Business’s Efficiency

In today’s fast-paced business environment, efficiency is critical to success. Businesses with efficient operations, highest production, and lowest waste have a competitive advantage. The difficulty is in developing original and […]

Read moreHow Insurance Can Keep Your Business Running

Any company can be disrupted by unexpected difficulties, which also cause operational setbacks and financial strain. Staying prepared guarantees stability and long-term success when dealing with property damage, legal conflicts, […]

Read moreAlgorithmic Edge: Transforming Data into Profit

Data is today the lifeline of modern financial markets. As billions of data points are generated daily, making sense of this data is no mean task. Algorithmic trading has been […]

Read moreWhat Are the Most Durable Roofing Materials for Homes and Businesses?

More than just a protective cover, a roof is a necessary component of structural integrity, energy economy, and the lifetime of a building. The correct roofing material will help a […]

Read moreMRT-3 Assures Commuters: No Fare Increase Planned Amid LRT-1 Hike

Metro Rail Transit Line 3 (MRT-3) General Manager Michael Jose Capati has reassured passengers that there are no immediate plans to increase fares, even as the Light Rail Transit Line […]

Read moreAirAsia Unveils P44 Promo Fares for 4.4 Summer Seat Sale

Budget airline AirAsia is making summer travel more affordable with its latest 4.4 Summer Seat Sale, offering one-way base fares for as low as P44. With over 400,000 seats up […]

Read moreThe 6 Smartest Ways to Use Cashbacks for Online Shopping

Deals are a must for frequent online shoppers, as these allow them to save money while making sure their budget goes a long way. This is precisely the reason many […]

Read moreDTI to Introduce Digital Loan Program for Micro Entrepreneurs

The Department of Trade and Industry (DTI) is set to roll out a new loan initiative tailored for micro entrepreneurs, offering accessible financing through popular e-wallet platforms. This innovative program, […]

Read moreHow to Protect Your Business During a Natural Disaster

Unexpected disasters can halt operations, resulting in financial loss and long-term damage to a business. Unpredictable natural disasters like earthquakes, floods, wildfires, and storms leave businesses scrambling to recover. Businesses […]

Read moreWhere Should Businesses Allocate Their SEO Budget?

Search engine optimization (SEO) continues to be vital to a successful digital marketing strategy. Businesses must stay ahead of the competition and invest wisely in SEO services to increase conversions […]

Read more

Comments