According to Robert Glover, global fund distribution partner at PwC Luxembourg, ETF issuers are using a more focused approach when registering their products in Europe by choosing to pursue regions where demand is strong rather than implementing a regionally broad distribution strategy.

According to PwC’s most recent European ETF Listing and Distribution report, Denmark was recognised as the top market for ETF distribution in the year leading up to the end of June, recording 256 ETFs.

However, 216 of these came from just two ETF issuers—138 from Amundi and 78 from WisdomTree—underscoring the selective approach issuers are taking to the markets. The issuers used the same strategy in Finland and Spain, where they are responsible for nearly all of the 205 and 206 registrations, respectively.

In an interview with ETF Stream, Glover stated that “the days when asset managers would first arrive in Europe, set up shop in Ireland or Luxembourg, and register across 15-20 various nations are long gone.

It is now necessary to approach it slightly more fragmented by first registering in three or four nations before expanding from there. Because they anticipate strong investor demand, ETF issuers are stating that they “will definitely go for it in these specific areas.”

The trend is considerably more pronounced for more recent and modest market entrants.

For instance, the AXA IM ACT Biodiversity Equity UCITS ETF (ABIU) was only listed in Germany when AXA Investment Managers first entered the European ETF market earlier this month.

Before extending its distribution to other countries, the French asset manager stated that it would first evaluate market demand.

Outside of Europe, this trend is also expanding, according to Glover. In Israel, a fairly open and developing market for ETFs, BlackRock, and Vanguard made a significant push last year.

“This year, Saudi Arabia is where we are seeing it, with 70 registrations, 70-80% of which came from BlackRock alone.”

The demand for various asset classes in various markets may also be a factor. For instance, ETF issuers may focus on the UK and Italy for short-term and leveraged products while increasing the number of ESG-related ETFs registered in the Nordic region.

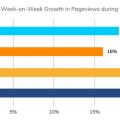

The research claims that the number of ETFs listed on the London Stock Exchange increased by 19% in the 12 months leading up to the end of June, representing the biggest increase in Europe. However, a major portion of them will have taken the form of leveraged, short-term ETPs that were released in bulk. A detailed outlook on Europe’s ETF market can be found at one of our favorite blogs on the web – European ETF Market Outlook 2022 – BHFT

“There are markets where there are significant product launches, and issuers desire the cohesion of listing in one location,” Glover continued.