This year saw unprecedented changes in the real estate market and in the economy overall. Barely recovered from the Taal eruption in January, the Philippines had to adjust to government-imposed restrictions on movement, which affected all commercial sectors. Even in the residential segment, there have been drastic changes week-on-week, observed in Lamudi’s data from January to the first half of June 2020.

The pivotal week for the residential sector was week 12, March 15-21, the week covering the start of the enhanced community quarantine (ECQ) on March 16. From this week, each property type saw sharp highs and lows until the shift to the MECQ.

SOURCE: Lamudi.com.ph

The ECQ in the Philippines was implemented by the government’s Inter-agency Task Force (IATF), with set restrictions that only allow going out of the house for buying essential goods and essential businesses to operate on a skeletal or work-from-home arrangement. Public transportation was also suspended; essential workers such as healthcare providers and their employers were advised to look for temporary housing nearer their workplaces.

Looking deeper into Lamudi’s data, following the sharp week-on-week decrease in interest and inquiries, the market bounced back around the implementation of the MECQ. The shift from the ECQ to MECQ in the National Capital Region happened on May 16.

Now that Metro Manila is back in GCQ, along with Cavite, Rizal, Bulacan, and Laguna, Lamudi aims to provide a snapshot of what has happened thus far, and how community quarantine changes have impacted the residential market.

THE RESIDENTIAL SEGMENT’S RESPONSE TO COMMUNITY QUARANTINES

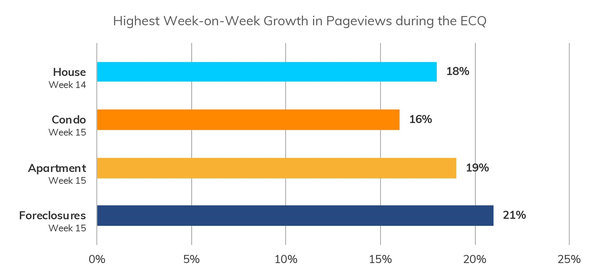

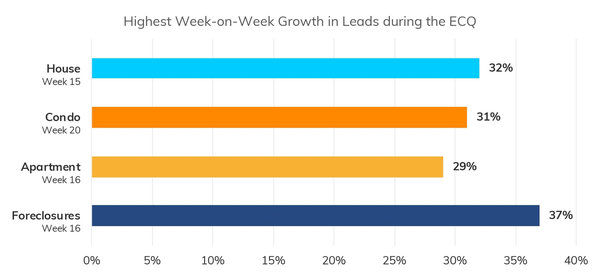

Lamudi’s initial trend report surveying property seekers, real estate brokers, and property developers, published in May, showed a renewed interest in house and lot properties after the ECQ has been implemented. This trend seems to continue on a climb to reach pre-COVID percentages on the platform during the start of the year,as it showed a huge week-on-week increase in inquiries (32%) in week 15 (April 5-11) from a huge drop following the announcement of the ECQ at week 12 (March 15-21). Inquiries about houses also saw a 30% week-on-week increase during the shift to MECQ at week 20 (May 10-16).

SOURCE: Lamudi.com.ph

Property seekers remain interested in condominiums but are still on wait-and-see mode

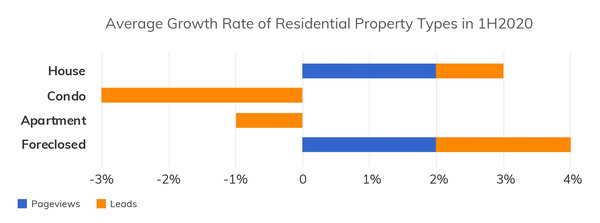

Condominiums had a strong start in 2020, owing in part to the interest in property investment carried over from the previous year. However, due to the pandemic, condominiums recorded an average week-on-week lead growth rate of -3% in the first half of 2020. Though condominiums showed a drastic decrease in leads at the start of the ECQ, there was retained interest in the property type. In Lamudi’s previous trend report, it was revealed that 34% of surveyed property seekers are considering a property purchase a year or longer into the future, another 34% are considering a purchase in 6-12 months, and around 22% want to keep their timeframe open.

Homeownership hinges on affordability

SOURCE: Lamudi.com.ph

Houses, which showed a strong performance during the ECQ according to a survey of Lamudi property seekers, posted a 2% average week-on-week growth in pageviews for the first half of 2020. Foreclosed properties also showed resilience amid the pandemic, ending at an average lead growth rate 1% higher than houses. During the ECQ, affordability was a major consideration for property seekers, which is seemingly affirmed by the increase in leads gained by foreclosures (37%) on Lamudi at week 16 (April 12-18).

FACTORS AFFECTING PROPERTY SEEKING BEHAVIOR IN THE TIME OF COVID-19

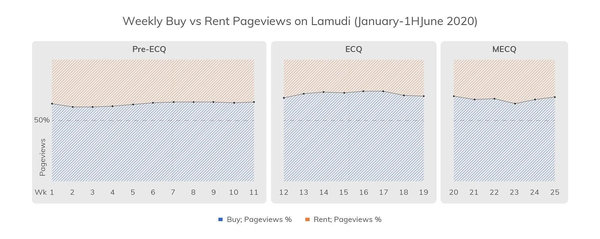

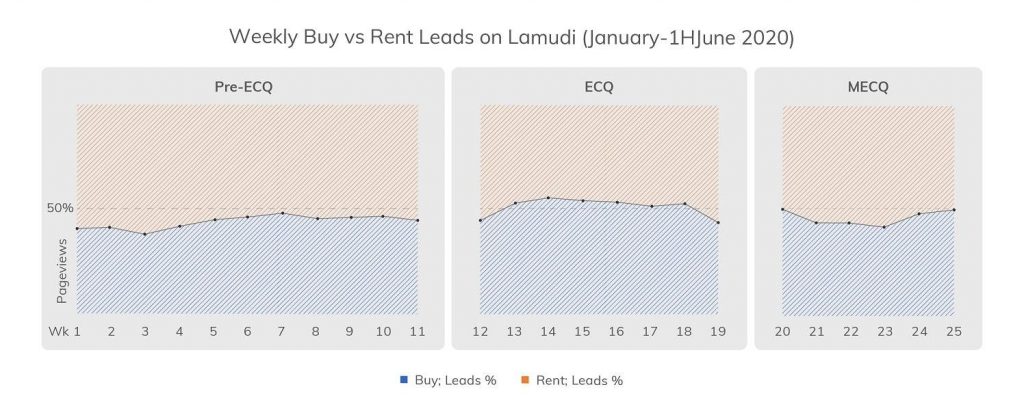

For property seekers, location and the presence of functional and recreational amenities have been some of the main considerations in their property purchase during the first half of 2020. Given the restriction on movement, the periods covered by the ECQ and the MECQ also impacted the decision to buy or rent.

Investing in real estate given more thought during the ECQ

SOURCE: Lamudi.com.ph

From January to early March, before the ECQ, properties for sale received somewhere around 63-66% of pageviews on Lamudi, but properties for rent, despite having fewer listings on the platform, received more inquiries at around 53-63%. This shows that property seekers have an intention to buy, but followed through with rental inquiries.

During the ECQ, interest in buying property rose to 68-74%, with property seekers continuing to inquire as well, contributing to almost 56% of inquiries on the platform during the ECQ.

SOURCE: Lamudi.com.ph

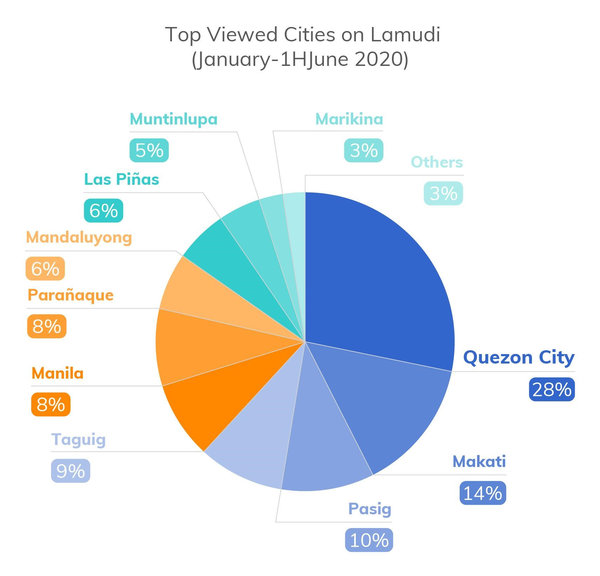

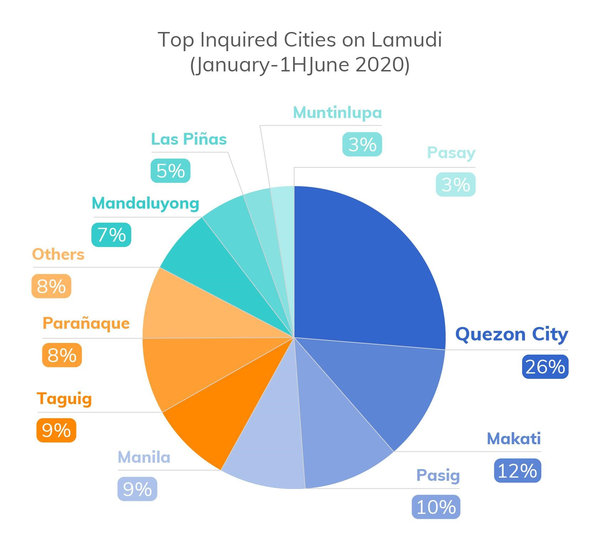

Cities with CBDs continue to be popular

SOURCE: Lamudi.com.ph

In Lamudi’s trend report about the real estate movement in the Philippines amid the ECQ, a survey of property seekers showed their preferences switch from CBD to non-CBD properties during the ECQ. Two months later, with a look into seeker behavior for the first half of the year, CBD properties show long-term resilience.

In terms of property locations, most of the leads were looking for a property to buy or rent from Quezon City, which comprises 26% of the leads from January to the first half of June. Following are Makati (12%), Pasig (10%), and Taguig (9%), all NCR cities with a central business district.

Three CBDs are in Quezon City: Eastwood City, Araneta City, and Triangle City. Makati City’s CBD is in the Ayala Makati area. Meanwhile, Pasig City has the Ortigas Center, and Taguig City has Bonifacio Global City.

Since public transportation has been suspended from March to May and is on limited operations, property seekers may have looked for residential properties closer to their workplaces, especially those who have been deemed as essential workers and are at higher risk to the virus. This move can also keep their loved ones safe from the virus, especially if there are family members that are more susceptible to COVID-19.

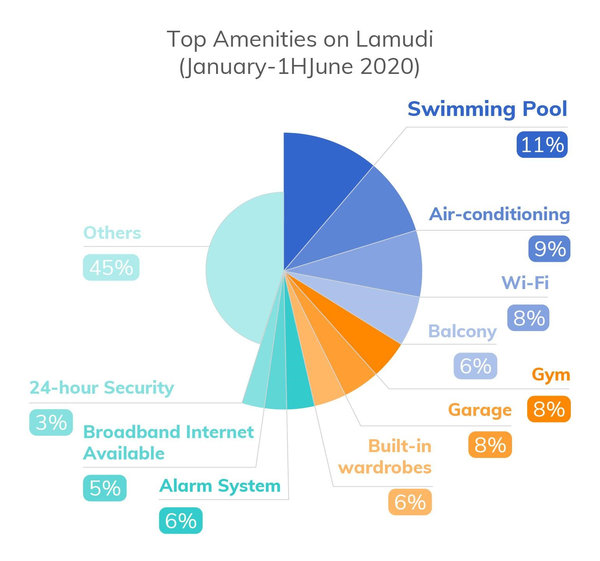

Property seekers prioritize amenities that improve quality of life

SOURCE: Lamudi.com.ph

For the first half of 2020, property seekers considered their leisure and quality of life when looking at property listings on Lamudi. This showed in the top searched amenities on the platform:

1. Swimming Pool (11 percent)

2. Air-conditioning (9 percent)

3. Wi-fi (8 percent)

4. Balcony (6 percent)

Since the ECQ was implemented during the summer months, properties with either a common swimming pool or have air conditioning were popular. Meanwhile, having a stable internet connection has also become a necessity during these times as virtual events and work-from-home setups are the new normal during the community quarantine.

Aside from connectivity amenities, seekers also prefer properties with balconies and common gym areas. Balconies serve as an area for activities and hobbies that the seeker may enjoy while staying at home, while common gyms are good alternatives to the commercial gyms that have closed down during the ECQ.

RESIDENTIAL MARKET CHANGES IN THE FIRST HALF OF 2020

The recovery of the residential segment highlights new priorities for property seekers and reveals factors that still remain important for buyers and renters with or without a health crisis.

In summary, here’s what we learned:

- Despite experiencing dips during the ECQ, CBD properties continue to be popular as a real estate investment.

- Connectivity amenities will no longer be a want; they are a need for work-from-home setups and extended stays indoors.

- The increased interest in properties for sale shows property seekers considering investment options despite the ECQ.

- The affordability of foreclosed properties contributed to its resilience amid the pandemic.

- The strong performance of condominiums at the start of the year waned slightly during the strict community quarantines. The slight dip in inquiries but relatively stable interest may be due to property seekers holding on to cash amid uncertainties.

- The renewed interest in houses during the ECQ carried over to MECQ.

With Metro Manila back in MECQ for two weeks at the start of August, a temporary shift can once again be expected in the residential market. With this, the second half of 2020 may show new trends in real estate demand and preferences from property seekers who have to adapt to the rules set in place during changing community quarantines on a more long-term basis.