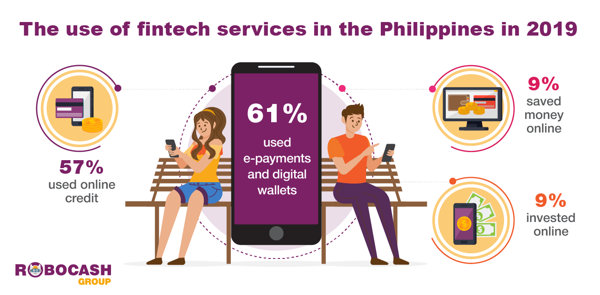

Online payments and digital lending are in priority for the Asians when it comes to frequently used financial services. According to the survey of fintech customers by Robocash Group, almost two-thirds of the respondents in the Philippines applied for online credit and made e-payments in 2019.Conducted in the second half of January 2020, the survey covered the Philippines, Vietnam, Indonesia and India. The findings revealed a relatively even penetration of online financing across these markets. On average, 61% of respondents in these countries applied for online credit in 2019 at least once. The usage in the Philippines was 57%. Indonesia had 61%, while India and Vietnam – 63% and 64%, respectively. A rapidly growing consumption explains the higher figures of the latter. India and Vietnam have the lowest income per capita among the mentioned markets. Still, they tremendously outpace neighbours in terms of growth rates. That suggests more often recurring gaps in family budgets of people. At the same time, an increase in welfare helps to diminish the debt load.

In general, an urgent, unexpected need remains to be the main reason to apply for fintech financing. Most often, Asians used relevant services in 2019 only once or twice for the whole year. India had the highest share of such customers – 31%. The Philippines and Vietnam followed with 28% and 27%, respectively. Indonesia had 24%. Remarkably, only one in ten respondents used online credit almost monthly, i.e. more than 10 times a year.

At the same time, e-payments and digital wallets have become an integral part of life for Asians. In 2019, the strong majority of respondents (67%) used them at least once. More than half of that number (56%) made digital payments more than twice a week. With regard to a regular monthly usage, respondents from Vietnam were most active in 2019 (63%). There followed India (51%), Indonesia (49%). The Philippines had 42%, but people using e-wallets more than twice a week made up the largest part of that number (79%).

Finally, digital savings and investments in the Philippines, as well as in other countries, demonstrated the lowest penetration – both at 9%. The reason why the segment is lagging is in the fact that such services suggest serving customers earning higher incomes and saving money. At the same time, improvements in financial inclusion and financial literacy promise to advance the industry soon.

ABOUT:

Robocash Group is an international financial group operating in the segments of consumer alternative lending and marketplace funding in Europe and Asia. The company develops robotic financial services providing micro consumer lending to customers in Russia, Kazakhstan, Spain, the Philippines, Indonesia, Vietnam and India and operates the own EU-based p2p investment platform. The group develops products completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business.