The Social Security System (SSS) has released the updated SSS Contribution Schedule for Land-Based Overseas Filipino Workers (OFWs), effective January 2025. This change follows the Social Security Act of 2018 (Republic Act No. 11199), which mandates a 15% contribution rate and an increase in the Monthly Salary Credit (MSC) to PHP 35,000.00.

For OFWs, understanding the new SSS contribution rates is essential to ensure compliance, avoid penalties, and maximize future benefits such as retirement, disability, maternity, sickness, and death benefits. This article provides a comprehensive breakdown of the latest contribution rates, including the impact of the Mandatory Provident Fund (MPF) program.

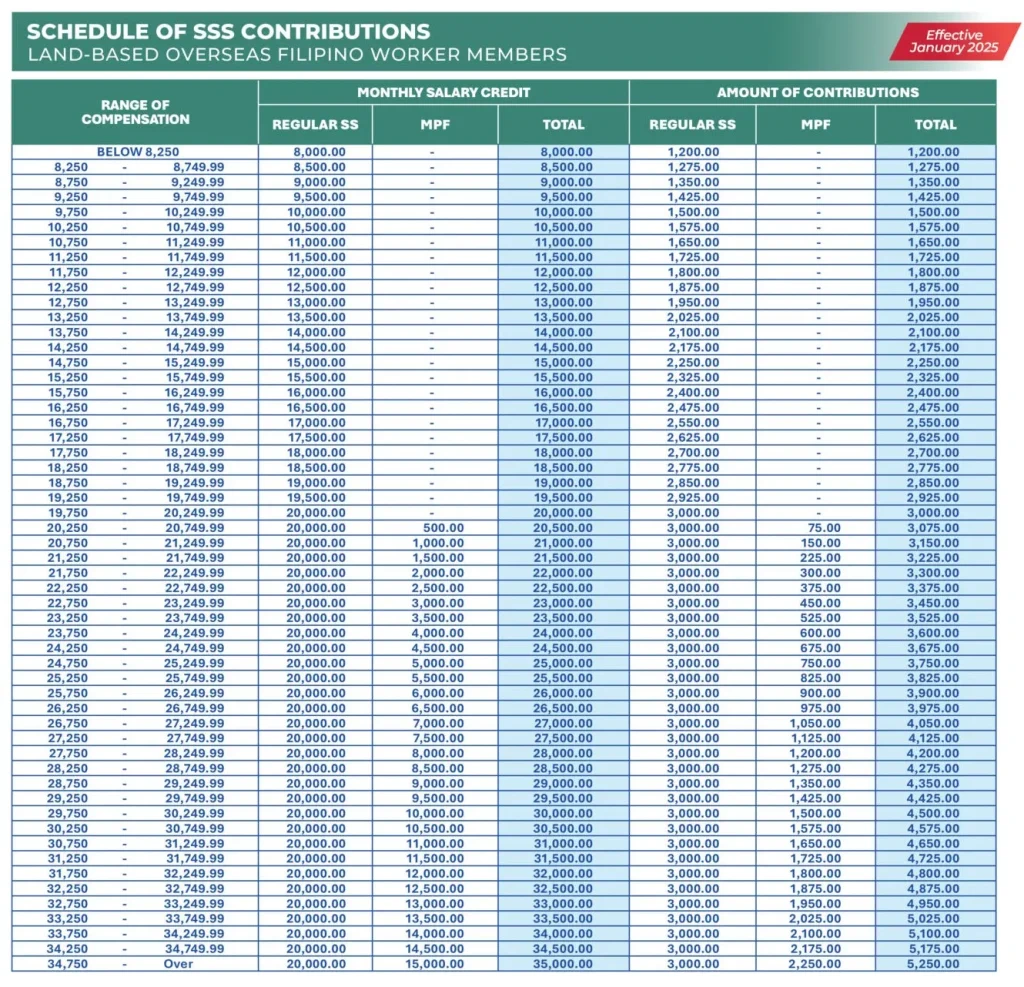

New SSS Contribution Table for Land-Based OFWs (Effective January 2025)

Below is the latest SSS contribution table for land-based OFW members based on income brackets:

Table: 2025 SSS Contribution Rates for OFWs

Note: For OFWs earning above PHP 20,000, the excess MSC (up to PHP 35,000) is allocated to the Mandatory Provident Fund (MPF) for long-term savings and investment growth.

Key Updates in the 2025 SSS Contributions for OFWs

1. Contribution Rate Increase to 15%

The contribution rate has increased from 14% to 15%, which means higher contributions but also higher future benefits.

2. MSC Ceiling Raised to PHP 35,000

The maximum Monthly Salary Credit (MSC) has been raised to PHP 35,000, allowing higher earners to contribute more towards their future retirement and benefits.

3. Mandatory Provident Fund (MPF) Contributions

For OFWs earning above PHP 20,000, the excess amount goes into the SSS MPF program, which provides investment-based savings for retirement.

Computation of Benefits Based on New SSS Contributions

Your SSS benefits (retirement, disability, maternity, sickness, unemployment, and funeral) are computed based on your MSC. Here’s a breakdown of how your contributions impact benefits:

✔ Retirement Benefits – The higher your MSC, the bigger your pension upon retirement.

✔ Disability and Death Benefits – These benefits are based on your total contributions and investment returns.

✔ Maternity and Sickness Benefits – The higher your MSC, the higher your daily cash allowance.

Advance Payment Rules for OFWs

🔹 If you paid contributions in advance before January 2025, your payments will be adjusted according to the new MSC.

🔹 If your advance payment is below PHP 8,000, you will need to pay the difference to meet the new minimum.

🔹 If you paid for a higher MSC, your payment will be credited at the corresponding new rate.

Why OFWs Should Continue SSS Contributions

1️⃣ Retirement Security – Ensures that OFWs have a pension after working abroad.

2️⃣ Loan Eligibility – Active contributors can apply for SSS salary and calamity loans.

3️⃣ Disability and Death Benefits – Protects OFWs and their families in case of emergencies.

4️⃣ Investment Growth via MPF – Additional savings for future financial security.

Final Thoughts

The 2025 SSS contribution update for OFWs ensures better financial security, retirement benefits, and long-term savings. With the new 15% contribution rate and the MSC increase to PHP 35,000, OFWs can maximize their future benefits while contributing to their country’s social security system.

Spread the word! Share this with fellow OFWs to keep them updated about the latest SSS changes.