A successful business means earning significant profits by investing less and converting SMBs into large-leading brands. Such goals can only be achieved by expertise. That’s why it becomes essential for businesses to affiliate with reputable accounting automation agencies that can facilitate them with all the bookkeeping and accounting automation services. Enterprises can benefit other businesses by affiliating them with financial management digital accounting service provider agencies. In this blog, learn how entrepreneurs benefit from outsourced accounting automation.

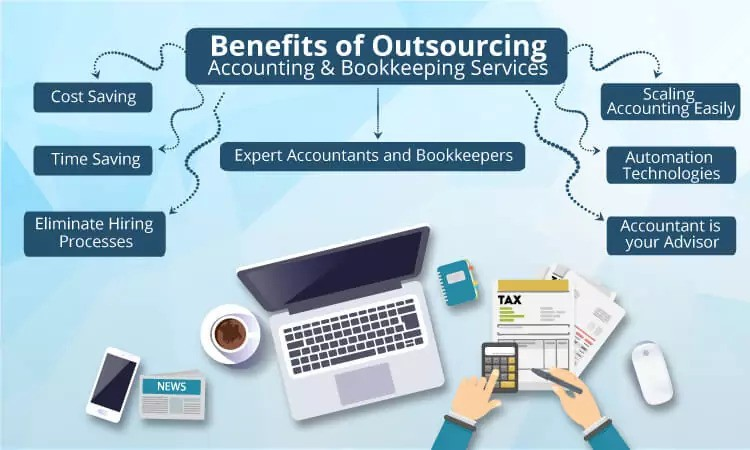

Benefits Of Outsourcing Accounting Automation

Outsourcing accounting automation from a reputable firm that provides all kinds of digital financial management and accounting automation services has many benefits. The following are the benefits of automated bookkeeping and accounting:

- Cost saving

- Time-saving

- Better decision making

- Detecting frauds and scams

- Tracking transactions

Cost Saving

Entrepreneurs can save money by investing in their businesses and earning significant profits. The most successful company is that which is more reliable in generating accurate financial data reports and records. Intelligent enterprises know how to avail all the facilities from outsourcing accounting automation and save significant amounts of money by smartly investing in financial management service provider agencies.

Time Saving

Accounting Automation helps save time for more strategically complex tasks that require more human expertise. Outsourcing accounting automation makes it easier for financial management teams to perform day-to-day financial operations more quickly. That’s how outsourced accounting automation is the most innovative method for saving time.

Detect Frauds or Scams

There are possibilities that in-house financial management staff may commit fraud or scams take place within the organizations in financial management data reports and records. If businesses have outsourced accounting automation services, it becomes easier for them to track the finance details and detect frauds and scams.

Better Decision-making

Entrepreneurs must make the best decisions for their enterprises to convert them into large leading brands from SMBs. It’s become essential for businesses to affiliate themselves with reputable accounting automation service providers as they have teams of highly skilled professionals who can guide entrepreneurs regarding all financial management strategies, which help them make the best and better decisions.

Tracking Transactions

Nowadays, with digital advancement, it has become easier for companies to track any kind of false or fake transaction to secure the reliability of enterprises by outsourcing the services of accounting automation and bookkeeping. In this way, entrepreneurs can take required actions quickly, enhancing reliability by tracking the transactions from the saved financial management data records.

Gain A Competitive Edge In The Market

With cost effecting and expertise in outsourcing accounting automation, it helps businesses to manage and perform all the financial tasks properly. For businesses, it’s essential to embrace accounting automation services from reputable automated bookkeeping and accounting services to flourish their company. Especially for small-medium companies, outsourced accounting automation services are more beneficial to gain a competitive edge in the market and convert them into large-scale leading brands.

Earn More Profit

Enterprises need to make intelligent investments in reputable firms to outsource accounting automation that knows everything related to AI-powered tools and cloud-based software. Such agencies have highly skilled professionals who know every financial management strategy that can be beneficial and implemented in the affiliated companies to manage the economic data properly. That’s how businesses have fewer chances of tax penalties and loss and can easily earn more profits than investments.

Smart Reconciliation

Smart reconciliation through accounting automation helps make accurate and reliable reconciliation reports of all kinds of financial data, which includes payrolls, transactions, incomes, and much more. Automated accounting systems help generate more secure financial data details by comparing two or more different financial records to make accurate reports and records.

Conclusion

With the swift advancement in technology, business owners should empower the latest methods of financial management that help enhance reliability. Outsourcing accounting automation services is one of the most innovative ways to manage every kind of finance-related data, information, transactions, reports, and records. Businesses that have outsourced the advanced services of accounting automation can easily enhance the customers’ reliability, which in return can help gain a competitive edge in large-scale industries. That’s why embracing the latest trends in financial management, accounting automation, and bookkeeping becomes essential, especially for small-medium businesses. SMBs need to outsource the advanced system of accounting automation to resolve the day-to-day financial operations more quickly. They can easily save time and energy from manual labor to deal with more complex organizational tasks. In this way, small-medium companies can convert themselves into large leading brands.