Many people possess both debit and credit cards and use them for their many purchases. Even though people own both cards, some people might still have trouble determining the differences between the two cards since they’re incredibly similar to one another.

The two plastic cards work differently. People can only use a credit card to borrow money from the bank within their credit limit, while debit cards are used by withdrawing money directly from the cardholder’s account.

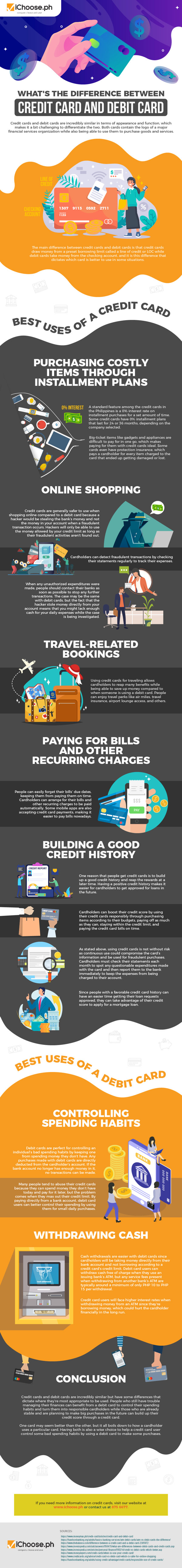

Credit cards are perfect for buying costly items through installment plans, online shopping, travel-related bookings, bills, and building a good credit history. There’s less risk when using credit cards compared to debit cards since any questionable expenses can be reported to the bank to keep them from being charged to their account.

Debit cards are different from credit cards since cardholders are using the money stored in their accounts for their purchases and cash withdrawals. Since people will be using their money, debit cards are excellent for controlling their spending habits by keeping them from spending the money they don’t have.

Both credit cards and debit cards bring convenience to their owners since it allows them to make purchases even when they don’t have any money on hand. For more information on the differences between credit cards and debit cards, as well as their best uses, see this infographic by iChoose.ph.