Users of online financing services aged 31-34 more accurately match their needs in finance to actual capabilities. In comparison to other age groups, they apply for such amounts, which size is the closest to the approved. These are the conclusions of analysts of the financial holding Robocash Group after studying customer applications received since the beginning of 2019.

The study involved data of the company’s online financing services in India, Indonesia, Vietnam, and the Philippines. The findings showed that among all applicants, 31-34-year-old customers in Asia have been most accurate in matching their needs in finance to actual capabilities. Overall, they obtained financing, which size was closest to the amount, which they requested initially. In contrast to them, applicants ages 18-24 have been less accurate by 7.9% and the eldest age group of 51-60 – by 12.3%.

At the same time, the analysts found some variations between age groups in these countries. For example, in India, when applying for online financing, customers ages 35–40 and 41–50 decided on amount most precisely. Young people in their 18 to 24 years old have been less accurate with a difference of 4.1%, while mature customers ages 51-60 have had a 17% deviation.

In Indonesia, Millennials ages 25-30 have demonstrated the best accuracy. Compared with them, the 18-24-year-olds have turned out to be less precise (4.6%). At the same time, among the company’s Asian markets, the elder Gen X and younger Baby Boomers (51-60) in Indonesia have shown the highest contrast with the most accurate group – 18.9%.

As for the Philippines and Vietnam, 31-34-year-old customers have been the best in matching their needs to financial capabilities. At the same time, the company noticed some noteworthy differences in requests among other age groups in these countries. In particular, both younger and elder Filipinos requested online financing relatively close to the approved amounts. The difference between them with Millenial in their early and mid-thirties has equalled 6.4% and 4.0%, respectively. In this respect, the Vietnamese from the same age groups have been far less accurate in their assessments: 19.5% and 16.8%.

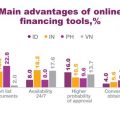

Commenting on the findings, the analysts of Robocash Group noticed: “Millenials were the first users of online financing tools in Asia. Unlike Generation X and Baby Boomers, they have felt more at ease trying digital services. As a result, they have obtained a deeper understanding of how fintech works and better financial literacy. The latter is particularly important when using new solutions. Over time, other generations will also improve their knowledge and become more accurate in assessing their finances. After all, it is only a matter of experience and knowing how to use relevant services wisely.”

—

ABOUT:

Robocash Group is an international financial group operating in the segments of consumer alternative lending and marketplace funding in Europe and Asia. The company develops robotic financial services providing lending to customers in Russia, Kazakhstan, Spain, the Philippines, Indonesia, Vietnam and India and operates the own EU-based p2p investment platform. The group develops products completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business.