Are you a voluntary SSS member or a non-working spouse? The Social Security System (SSS) of the Philippines has updated its contribution rates for 2026, which means higher contributions but better future benefits.

In this guide, you’ll find:

✔ The new SSS contribution table for voluntary members & non-working spouses

✔ How the Mandatory Provident Fund (MPF) applies to high-income contributors

✔ Where and how to pay your contributions easily

✔ How these changes affect your pension and benefits

Let’s dive in!

What’s New in the 2026 SSS Contributions?

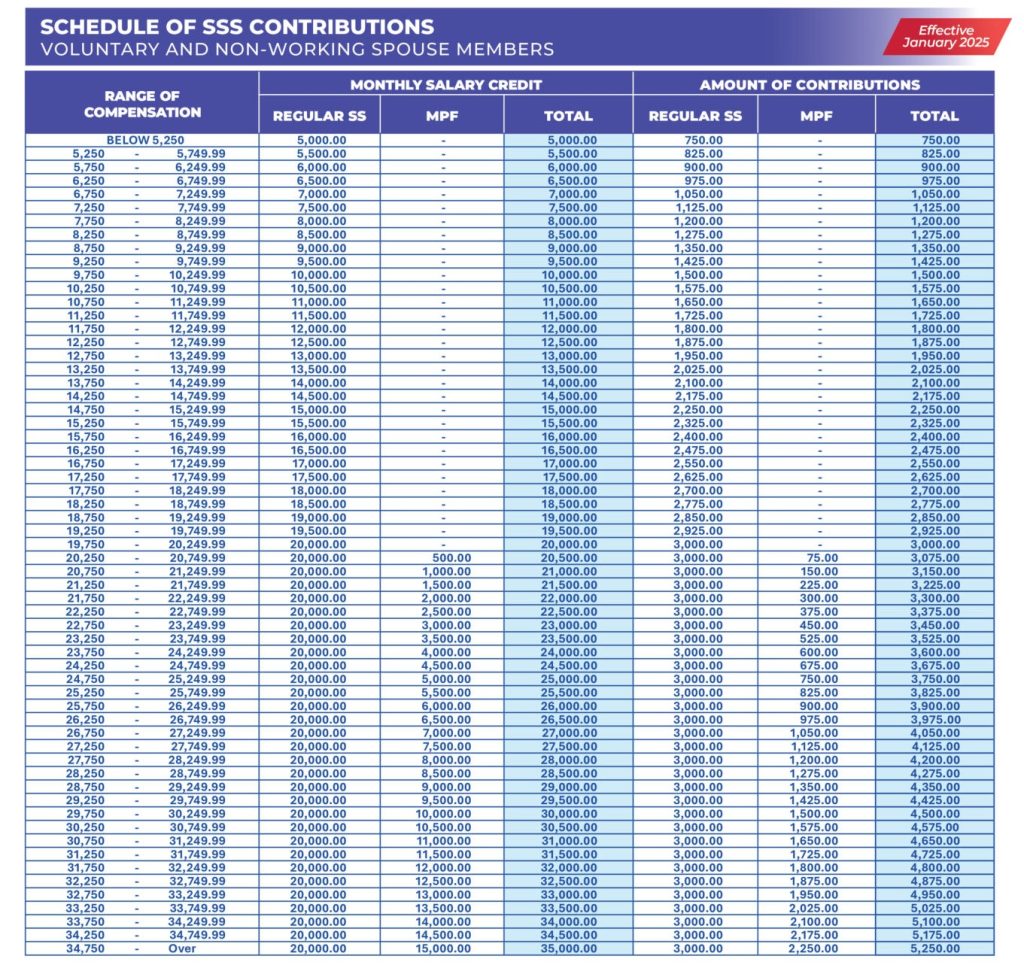

SSS has increased contribution rates to 15%, while the minimum Monthly Salary Credit (MSC) is now ₱5,000, and the maximum MSC is ₱35,000.

The Mandatory Provident Fund (MPF) also applies to members with an MSC of ₱20,000 or higher, helping them save more for retirement.

New SSS Contribution Table for Voluntary & Non-Working Spouses (2026)

This updated table applies to:

🔹 Voluntary Members – Previously employed individuals who wish to continue their SSS coverage.

🔹 Non-Working Spouses – Spouses of employed SSS members who want to build their own SSS contributions.

Important Notes:

✔ MPF contributions start at ₱20,000 MSC – This helps grow your retirement savings faster.

✔ Voluntary and non-working spouse members pay only their employee share, unlike self-employed members who cover both employer and employee shares.

What is the Mandatory Provident Fund (MPF)?

The MPF is an investment-type savings program that applies to SSS members with an MSC of ₱20,000 or more.

Why does MPF matter?

🔹 Your MPF savings earn interest, making it better than regular SSS contributions.

🔹 It ensures you have extra funds upon retirement.

🔹 Contributions stay in your account, unlike regular SSS contributions, which are pooled.

If your MSC is below ₱20,000, MPF does not apply to you.

How to Pay Your SSS Contributions as a Voluntary Member

Voluntary members and non-working spouses must manually pay their contributions through SSS-accredited channels:

Online payment methods

✔ GCash

✔ Maya (formerly PayMaya)

✔ UnionBank, BPI, Metrobank, Landbank, and other major banks

Over-the-counter payment centers

✔ Bayad Center

✔ SM Bills Payment

✔ ECPay partner stores

Overseas Payment Centers (for OFW spouses)

✔ iRemit, Ventaja, and other remittance centers worldwide

Tip: Always keep your payment receipt as proof in case of posting delays!

How These Contributions Affect Your SSS Benefits

Higher contributions mean bigger future benefits! Here’s how:

Retirement Pension – A higher MSC means bigger monthly pension payouts when you retire.

Maternity & Sickness Benefits – Higher contributions result in higher daily cash allowances.

Disability & Death Benefits – Your dependents will receive larger lump-sum payouts if something happens to you.

Bottom Line: Paying higher contributions now ensures financial security in the future!

FAQs (Frequently Asked Questions)

Can I change my SSS contribution amount?

Yes! Voluntary members and non-working spouses can increase or decrease their MSC once per year.

What happens if I miss a payment?

You won’t lose your SSS membership, but you may not qualify for benefits if you haven’t paid enough. Simply resume payments to stay active.

Can I pay my SSS contributions in advance?

Yes! You can pay quarterly, semi-annually, or annually to avoid missing deadlines.

How do I check my SSS contributions online?

Log in to your My.SSS account at www.sss.gov.ph to view your contribution history.

Final Thoughts

The new 2026 SSS contribution rates offer higher savings and better benefits for voluntary members and non-working spouses.

Action Steps:

✅ Check your new MSC category

✅ Start paying through online or accredited channels

✅ Monitor your SSS account regularly

Stay updated! Bookmark this guide and share it with your fellow SSS members.