The Social Security System (SSS) has released a new contribution schedule for Self-Employed (SE) members. This follows the Social Security Act of 2018 (RA 11199), increasing the contribution rate to 15% and adjusting the Monthly Salary Credit (MSC) to a minimum of PHP 5,000 and a maximum of PHP 35,000.

Self-employed Filipinos—such as freelancers, business owners, professionals, and gig workers—must understand these new contribution rates to ensure compliance, maximize benefits, and secure their financial future.

This guide provides a detailed breakdown of the new SSS self-employed contribution rates, including the impact of the Mandatory Provident Fund (MPF) program.

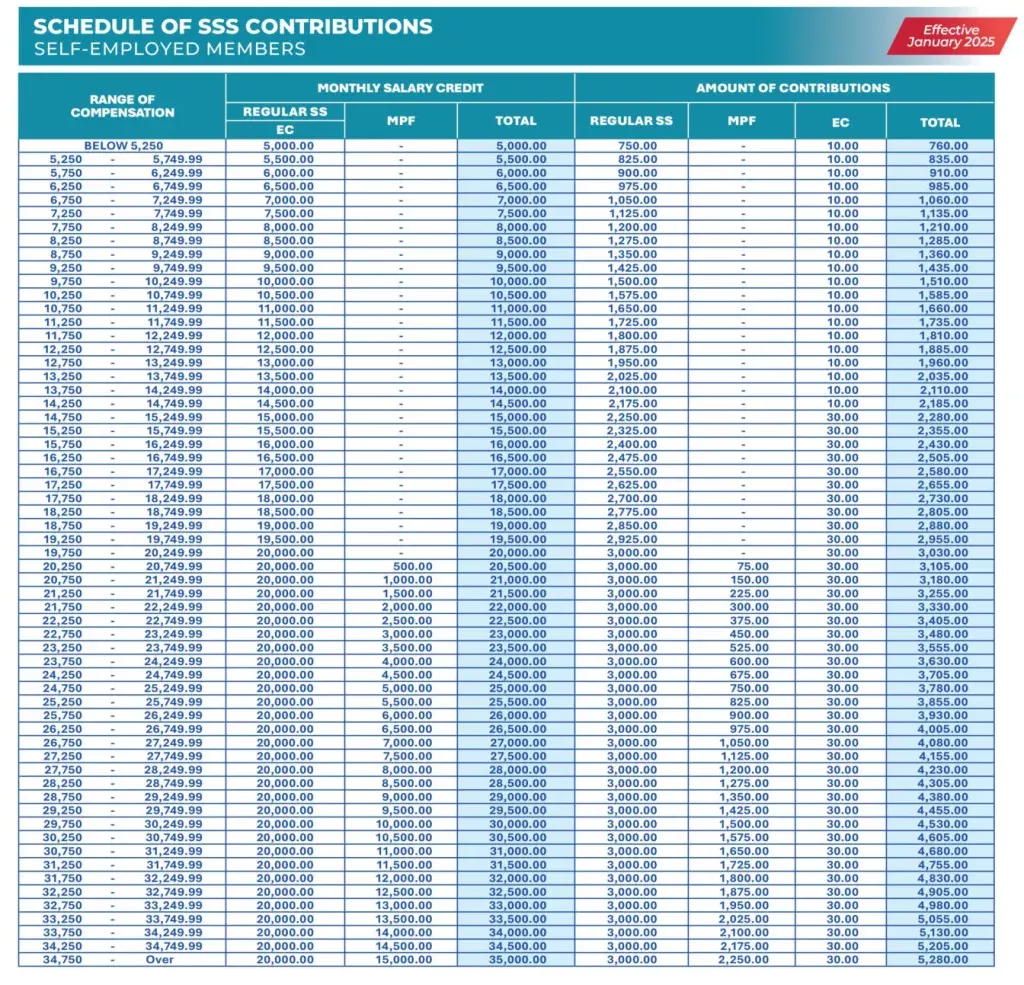

New SSS contribution table for self-employed members

Here’s the latest contribution table for self-employed members based on their monthly earnings:

Table: 2026 SSS contribution rates for self-employed members

👉 Note: Self-employed members earning above PHP 20,000 will have the excess MSC (up to PHP 35,000) allocated to the Mandatory Provident Fund (MPF) for long-term savings.

Key updates in the 2026 SSS contributions for self-employed members

✅ 1. Contribution rate increase to 15%

The SSS contribution rate is now 15%, meaning higher contributions and increased benefits.

✅ 2. Minimum MSC set at PHP 5,000

Self-employed members must contribute at least PHP 5,000 MSC, up from PHP 4,000 in 2023.

✅ 3. MSC ceiling raised to PHP 35,000

Higher earners can now contribute more, increasing their retirement savings and future benefits.

✅ 4. Introduction of MPF contributions

Self-employed members earning above PHP 20,000 will have part of their contributions allocated to the SSS MPF program for investment growth.

Advance payment rules for self-employed members

📌 If you paid in advance before January 2025:

✔ Contributions below PHP 5,000 will require an additional payment to meet the new minimum.

✔ Contributions at PHP 4,000 MSC will be credited with an underpayment of PHP 190 per month.

📌 If you contributed more than PHP 5,000 MSC, your payment will be adjusted accordingly.

Computation of benefits based on the new SSS contributions

Your SSS benefits are based on your Monthly Salary Credit (MSC) and contribution period.

💰 Retirement pension – Higher MSC = bigger monthly pension upon retirement.

💵 Disability & death benefits – Computed based on total contributions and investment returns.

🤰 Maternity benefits – The higher your MSC, the bigger your maternity cash allowance.

🚑 Sickness benefits – Your daily cash allowance depends on your MSC.

Why self-employed Filipinos should continue SSS contributions

🔹 Guaranteed retirement income – A steady pension for the self-employed.

🔹 Access to SSS loans – Self-employed members can apply for salary, calamity, and business loans.

🔹 Protection against emergencies – Disability, sickness, maternity, and funeral benefits.

🔹 Investment growth via MPF – Helps build long-term financial security.

Final thoughts

The 2026 SSS contribution update for self-employed members is a crucial step in ensuring better financial security and retirement benefits. With the new 15% rate and increased MSC ceiling to PHP 35,000, self-employed Filipinos can maximize their future SSS benefits while securing their financial future.

Share this with freelancers, entrepreneurs, and self-employed professionals! Let’s stay informed and financially prepared.