A Tax Residency Certificate (TRC) in the Philippines is issued by the Bureau of Internal Revenue (BIR) through The International Tax Affairs Division (ITAD). This document confirms your status as a tax resident, enabling you to claim tax treaty benefits or prove compliance with tax obligations.

Step 1: Verify Eligibility

Ensure you meet the residency requirements under Philippine tax laws. Typically, individuals and entities registered with the BIR can apply.

Step 2: Prepare the Required Documents

Gather the following:

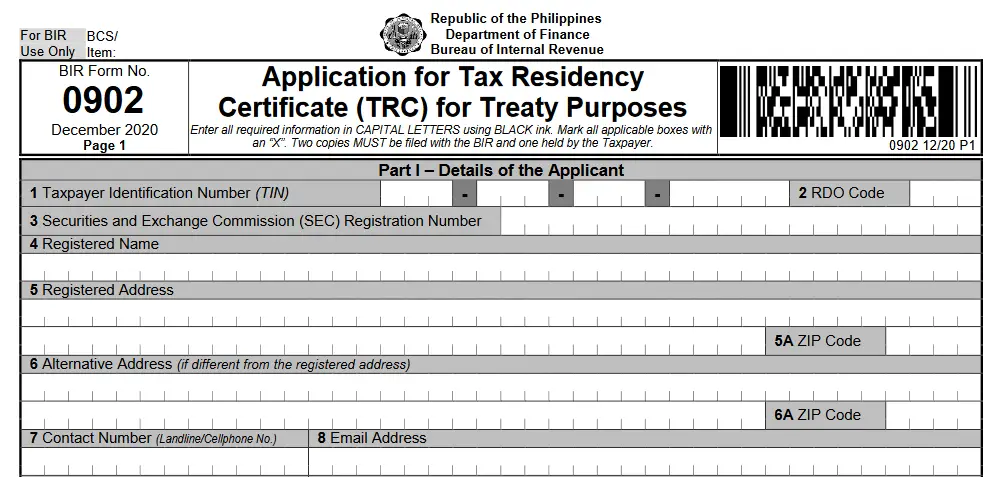

- Duly filled application form (BIR Form 0902).

- Tax Identification Number (TIN).

- Certificate of Registration (BIR Form 2303) for entities.

- Proof of residency (e.g., visa or government-issued ID for individuals).

- Copies of tax returns or receipts.

- Letter of request specifying the purpose of the TRC (e.g., availing tax treaty benefits).

Step 3: Submit Your Application

Go to the Revenue District Office (RDO) where you are registered. Submit the documents along with your application form. Ensure all documents are accurate and complete to avoid delays.

Step 4: Pay the Processing Fee

Pay the corresponding processing fee. Keep the official receipt as proof of payment.

Step 5: Await Processing

The BIR will review your application. Processing times can vary depending on the completeness of your documents and the workload of the RDO.

Step 6: Claim Your Certificate

Once approved, collect the Tax Residency Certificate from the BIR office. Verify the details to ensure accuracy.

Step 7: Use the TRC as Needed

Submit the TRC to the relevant authority, such as foreign tax authorities or treaty partners, to claim tax benefits or exemptions.

Tips for a Smooth Application

- Ensure all submitted documents are valid and up-to-date.

- Follow up regularly with the RDO to check on your application status.

- Seek assistance from a tax professional if you encounter challenges.

By following this guide, you can efficiently obtain your Tax Residency Certificate in the Philippines and enjoy its benefits.