Southeast Asia is a world-renowned tourist destination. From the beautiful beaches in Thailand to the tropical paradise islands that dot the coast of the Philippines, at first glance it seems like a dream destination to live. While this might be true in terms of lifestyle, these exotic lands have also gained a reputation for being the origin of many a scam. From fly-by-night call centers that try to convince people in other countries to invest in dodgy stocks, to pushing up the prices in the taxis or tuk-tuks when locals see a foreign face, scams abound.

What is less known though is that these scammers do not only target tourists, as many aim to prey on their fellow countrymen.

A TransUnion Consumer Pulse Survey was done that polled over 1,000 Filipino adults and found that 53% were targeted by fraudsters in the last 3 months of Q1 2022. This means that one in every two Filipinos had been targeted by fraudsters during this time period, which is a staggering number.

The same report also showed a decrease in the number of people that were actually scammed, going down from 11% in Q4 2021 to 8% in Q1 2022. This might not seem like a very high number, but we have to remember that a lot of people who get scammed feel ashamed and won’t admit to it, so these figures could be much higher.

While we can sit around and argue about what motivates these scammers, a more important question would be, “why are so many people getting scammed?”

People who fall victim to scams generally have a lack of knowledge in a certain area that the scammer targets in order. This can be clearly seen with investment scams. Here the targeted individual usually has a limited amount of knowledge about the financial industry and is then pushed into making investments that might be worthless or not exist at all. Many scam operators spend a lot of money on setting up elaborate infrastructure like websites, fake reviews, branded trading platforms, and so on, to fool the unwitting investor into thinking that they are dealing with a legitimate entity.

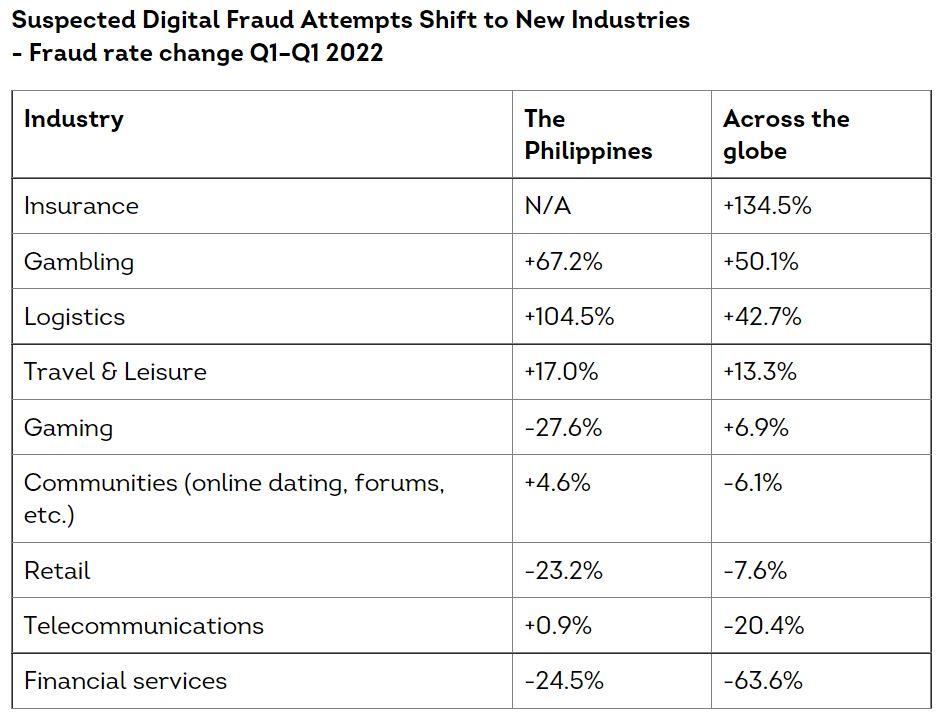

The Global State of Scams 2022 Report, which is put together by the Global Anti Scam Alliance (GASA) and ScamAdviser, found that in the Philippines scams involving financial services had fallen by 24.5% in Q1 2022. While this seems like a good thing at first, we need to remember that a lot of people might no longer have the cash available to invest in the financial markets, which might be a reason for the decline. This also does not mean that the number of scammers decreased, so people need to remain vigilant.

What can be done to help Filipinos avoid these scammers?

As the old adage goes, knowledge is power. No matter what the situation might be, the more you know the better the decisions you can make. This is the first key to staying safe and being able to navigate through the fraud-filled jungles of the internet. The biggest problem is finding resources that will give you good quality information that is trustworthy. This is where websites like investfox come to the rescue.

investfox offers a jam-packed Education section with a large variety of topics covering nearly any investable industry you could dream of. From guides explaining how to invest in Forex to detailed analyses of the wine industry and how to secure your money with bottles of wine or buying stocks in wineries, you are sure to find the answers there.

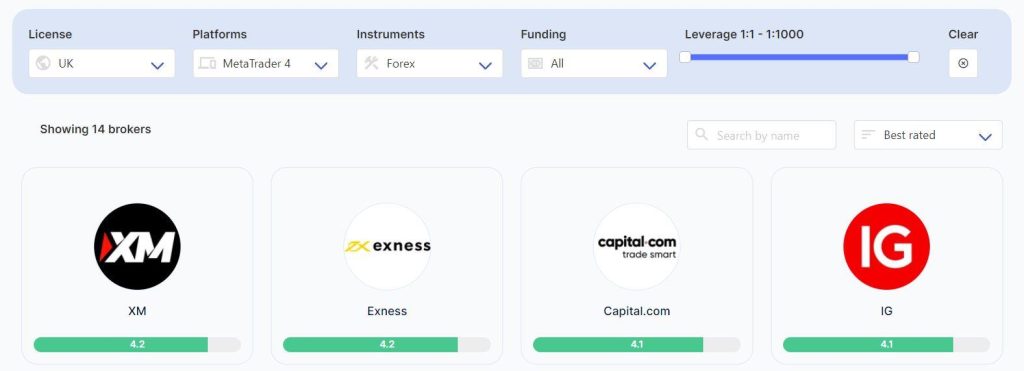

This is a good starting point, but even someone who understands every strategy can still be conned into sending their money to a fake broker. To help solve this issue investfox has poised itself as the Trustpilot of the investment world. Under the Reviews section, you will find brokerage reviews for all the leading legitimate brokerages on the internet today. Each review is done with an eye on giving consumers the most accurate information and so making the decision-making process safe and easy.

Not only will you find reviews by the investfox team, but individuals are also able to come to the platform and rate the brokerage based on their own personal experience. This helps others to get a true idea of what to expect from certain brokers.

With all this comes one of the best filtering tools on the market. You can look up brokers based on the licenses they hold, the platforms they allow you to use, the instruments you are able to trade, the funding options they allow for, and the amount of leverage on offer. Simply select the options you need and the list will automatically update.

Currently, the website is available in English and Bahasa Indonesia, but a Tagalog translation is in the pipeline.

All-in-all the best way that we can help not only people in the Philippines avoid scams, anyone looking to get into the financial industry, is by promoting platforms like investfox that focus on transparency. Good clear information will be what ends up making all the difference.

Global State of Scams 2022 Report – https://www.gasa.org/product-page/the-global-state-of-scams-2022-report

TransUnion Consumer Pulse Survey – https://content.transunion.com/v/consumer-pulse-ph-q1-2022