Why is Understanding Working Capital Important?

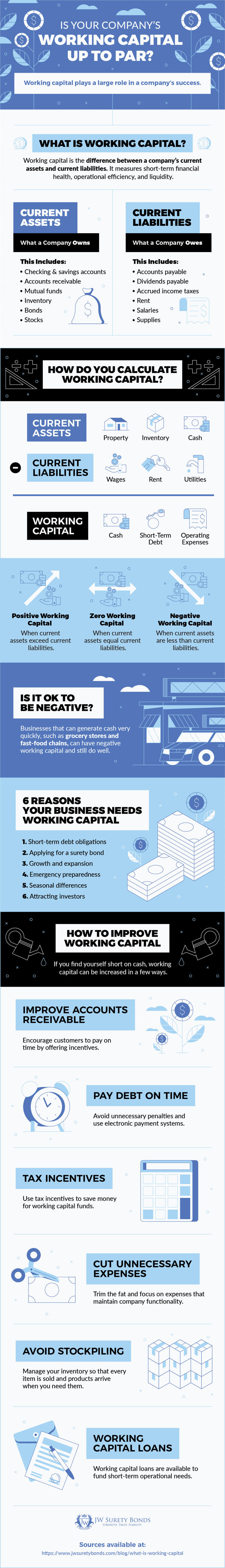

You may or may not be familiar with the term ‘working capital’. It’s an important business term for entrepreneurs to understand, and measures your business’ ability to pay off current liabilities with current assets. Working capital can also be an indicator of your company’s success and affects funding, inventory, and long-term growth.

To see if your company’s working capital is adequate, you need to first understand what exactly working capital is and why it is important.

Working Capital, Explained

Working capital, also referred to as net working capital (NWC), is a measurement of current assets minus current liabilities. It tells you the difference between what your business owns and what your business owes. It is an effective tool for understanding your company’s operational efficiency and short-term financial health.

Current assets (what your company owns), are tangible and intangible goods that can be turned into cash. These can include property, inventory, accounts receivable, mutual funds, stocks, and bonds.

Current liabilities (what your company owes) are debts or expenses incurred by your company within the past year. Current liabilities can include supplies, rent, utilities, accounts payable, income taxes, and salaries.

How to Calculate Working Capital

Working capital can be calculated as current assets less current liabilities, and measures short-term liquidity and the ability to pay off short-term debts.

Current Assets – Current Liabilities = Working Capital

Another method of determining working capital is the current ratio, which can indicate risk or irresponsible use of assets.

Current Assets / Current Liabilities = Current Ratio

For the current ratio, the general rule is that a higher ratio is better. However, this is dependent on your industry average. The goal is to be at or above your industry’s average.

Positive, Zero, and Negative Working Capital: What Does it Mean?

If your company has current assets that exceed current liabilities, it is referred to as positive working capital. Positive working capital indicates company health and high growth potential.

If your company has current assets that equal current liabilities, you have zero working capital. For industries that commonly deal with little or no inventory, this is common.

However, if your current liabilities exceed your current assets, you have negative working capital. In some industries like fast-food or grocery stores, this is acceptable because of the high turnover rates of inventory.

How to Improve Your Working Capital

If you have zero or negative working capital and want to improve, or even want to apply for something like a payment bond, here are some tips to increase your working capital.

- Increase accounts receivable. Incentivize your customers to pay on time to increase your accounts receivable.

- Capitalize on tax incentives. Tax incentives will help you save money that can be redirected towards working capital funds.

- Avoid back stocking. Having extra inventory means you have capital tied up in unused assets. By managing your inventory with a just-in-time method, you can minimize this.

- Get loans on working capital. You can take out loans to fund short-term operational needs if necessary.

It’s essential to monitor your working capital to ensure your daily operations are running smoothly. Effectively managing working capital is key to your company’s health, and can give you useful insight into whether you should expand or cut costs. For more information, check out JW Surety Bond’s infographic below.