Especially designed for franchising businesses, BPI Family Ka-Negosyo Franchising Loan offers affordable financing to enable you to start your franchise business today.

Pre-processing requirements

STANDARD REQUIREMENTS

GENERAL DOCUMENTS

- Duly Accomplished Application Form

- Photocopy of Income Tax Return (ITR) for the last 3 years

- Bank Statements for the past 6 months

- Copy of Marriage Contract, if applicable

(+) REAL ESTATE COLLATERAL DOCUMENTS

- Two (2) Photocopies of Transfer Certificate of Title (TCT) or Condominium Certificate of Title (CCT) – Owner’s duplicate copy

- Photocopy of Tax Declaration (land and building, if applicable)

- Payment of Appraisal Fee

(+) FOR FRANCHISING LOAN

- Franchise Endorsement / Contract with Franchise Owner

(+) FOR CONSTRUCTION / DEVELOPMENTAL LOAN

- Building Plan

- Building Specifications

- Bill of Materials

- Development Permit

- Subdivision Plan

- Feasibility Study

ADDITIONAL REQUIREMENTS

(+) FOR EXISTING ENTREPRENEURS

- Company Profile

- Photocopy of BIR-stamped financial statements for the last 3 years

- Photocopy of Business Registration Certificate / Business Permit / Latest General Information Sheet

- Photocopy of SEC-validated Articles of Incorporation / By-Laws, if corporation

- Resume of Major Stockholders, if corporation

(+) FOR EMPLOYED / FIRST TIME ENTREPRENEURS

- Updated Certificate of Employment indicating salary, position, and tenure

- Resume of Loan Applicant

- Certificate of Employment authenticated by Consul Office, if Overseas Filipino

1. Who are eligible to apply for a BPI Family Ka-Negosyo Business Loan?

| Term Loan | · Filipino Citizen, of legal age but not more than 65 years old upon maturity of the loan. · Entrepreneur with at least 3 years of profitable business operation; or, individual with at least 3 years stable income (professionals, OFs, employees) |

| Credit Line | · Filipino Citizen, of legal age but not more than 65 years old upon maturity of the loan. · Entrepreneur with at least 3 years of profitable business operation. |

| Franchising Loan | · Filipino Citizen, of legal age but not more than 65 years old upon maturity of the loan. · Entrepreneur with at least 3 years of profitable business operation; or, individual with at least 3 years stable income (professionals, OFs, employees) Note: Parents may co-borrow together with children who are of legal age |

2. How much can I borrow?

| Term Loan | · Minimum of PHP 500,000 Loan Amount · Maximum of 70% of appraised value of house and lot · Maximum of 60% of appraised value of vacant lot or residential condominium |

| Credit Line | · Loanable amount is subject to credit evaluation |

| Franchising Loan | Franchising Loan for Best List Brand Partners · Minimum of PHP 100,000 – depending on franchise packages available · 60% of Total Franchise Investment Franchising Loan for non-Best List Brands · Minimum of PHP 500,000 Loan Amount · 60% of Total Franchise Investment |

3. How much should my minimum household income be to qualify for a loan?

· Minimum of PHP 50,000

4. What are the loan terms available?

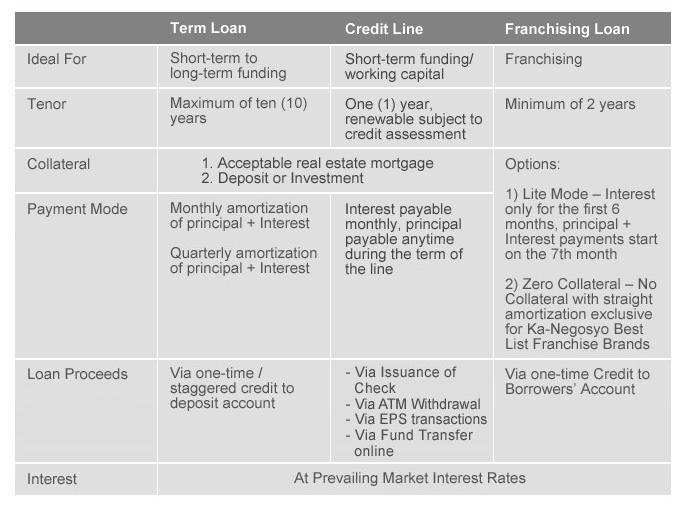

| Term Loan | · Minimum of 1 year · Maximum of 10 Years |

| Credit Line | · 1 year |

| FranchisingLoan | · Minimum of 1 year · Maximum of 3 Years |

5. What collateral is acceptable?

· Residential and Commercial Real Estate

· Bank Deposits

· No Collateral Option – available for Franchising Loans for Best List Franchise Brands. To check the list of Best List Franchise Brands, click here.

6. What are the requirements to apply and avail of a loan?

· To view complete list of pre-processing requirements, click here.

7. Where can I get more information about Ka-Negosyo Business Loans?

· For application forms and product information, product brochures are available in all BPI and BFB Branches nationwide.

· To know how Ka-Negosyo loans can be customized to the business expansion needs of negosyantes, call your Ka-Negosyo Account Officers servicing your areas.

· Else, e-mail us at kanegosyo@bpi.com.ph, call 754-NEGO(6346), text 0917-8KANEGO / 0922-869NEGO

If you’re ready to grow your business, it’s time to apply for a BPI Family Ka-Negosyo loan.

Apply online now

For any inquiries, contact them via email at kanegosyo@bpi.com.ph, fax # (02) 754-6887, or visit the nearest BPI or BPI Family Savings Bank branch.