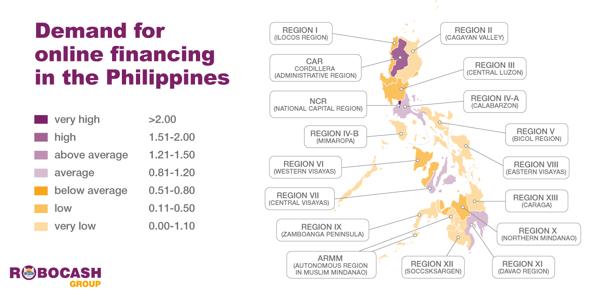

Based on the data of 1.52 millions of Filipinos who have used online lending services in 2019, the analysis has shown that urbanization facilitates online lending. The index of the capital region in the study is 5.34. It means that its predominantly young population distinguished for extensive usage of digital solutions and advanced consumption apply for online loans 5.3 times more often than on average in the country. It is confirmed by the fact that most of the customers live in highly urbanized Quezon, Makati and Manila. Within the total number of users of online lending services in the Philippines, they hold 36.9%, 16.8% and 6.3%, respectively.

The least populous region CAR takes second place with a rate of 1.83. The analysts of the company explain it by a high interest in online financing facilities among customers from the regional centre Baguio. Holding almost 100% of customers in the region, its share on the country scale amounts to 3.1%. There is a similar situation in Central Visayas and Region XI. Thus, on the country level, the region Central Visayas has 5.7% with its centre Cebu taking 5.3%. Then, Region XI holds 3.9% of customers in the country, while Davao residents take 3.8% on the same scale.

In accordance with the results, the regional demand for online loans has been divided by the following levels:

[2] The regional structure of the population has been taken from the current official data — the population census in August, 2015.

ABOUT

Robocash Group is an international financial group operating in the segments of consumer alternative lending and marketplace funding in Europe and Asia. The company develops robotic financial services providing lending to customers in Russia, Kazakhstan, Spain, the Philippines, Indonesia, Vietnam and India and operates the own EU-based p2p investment platform. The group develops products completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business.