Entrepreneurship in the Philippines has seen tremendous growth in recent years, with franchising emerging as one of the most attractive business models. Many aspiring business owners see it as a […]

Read moreBanking in the Modern Age: 6 Things That Have Changed Over the Years

Banking in the Philippines has come a long way from the days of long lines and manual transactions. Before, you’d have to visit a bank branch just to deposit money, […]

Read morePhilippine Wild Fruits Mistaken as Poisonous But Safe and Edible

Fruits are nature’s candy, but not all of them look—or smell—like a treat. In the Philippines, some fruits are ignored, even feared, simply because of their appearance or scent. But […]

Read moreSeeking Help: your Rights After a Workplace Injury

Workplace injuries can occur unexpectedly, transforming an ordinary day into a life-changing event. Whether resulting from dangerous machinery, hazardous environments, or neglected safety procedures, these events may leave workers wondering […]

Read moreGrowing Your Business? Here’s What You Might Need to Prepare For

Expanding a company is an interesting but difficult process that needs rigorous preparation, intelligent decision-making, and a strong awareness of possible difficulties. Growth entails controlling operations, guaranteeing financial stability, and […]

Read moreScaling Your Business: Everything You Need to Know

Scaling a firm is an important step that defines its long-term success and viability. Many business owners think that scaling is only about raising income, but it requires far more […]

Read morePsychological Pricing: How to Influence Customer Buying Decisions with Smart Pricing

In today’s competitive market, understanding how to influence consumer buying decisions is crucial. In the Philippines, businesses, especially small and medium-sized enterprises (SMEs), face the challenge of offering value while […]

Read more3 Ways Custom Awards Can Boost Employee Engagement

The success of every company depends on the involvement of its employees. Dedicated employees who feel appreciated put more effort and contribute to a good workplace. One great way to […]

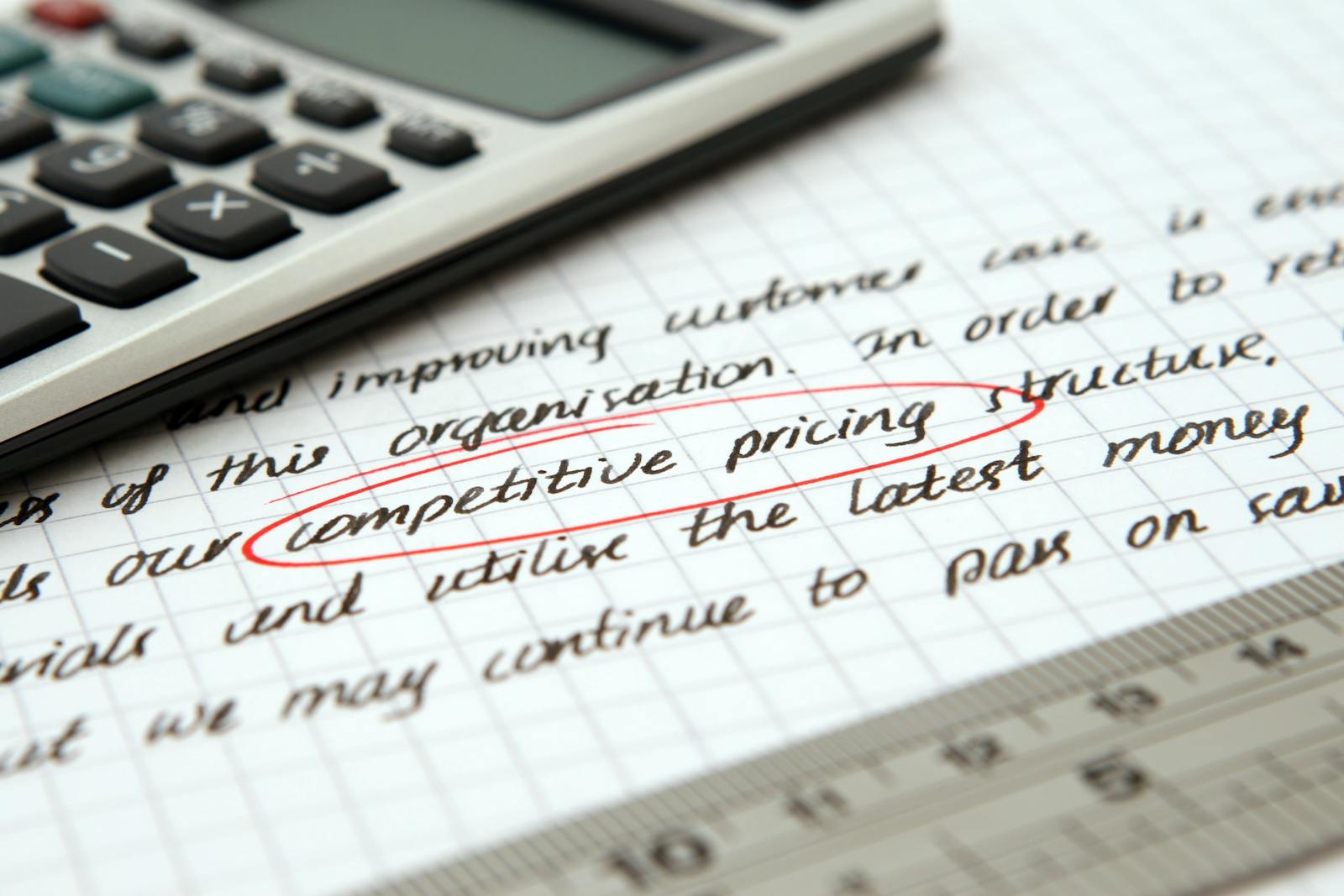

Read moreCompetitive Pricing Analysis: How to Price Your Products Against Competitors

Introduction Pricing is one of the most critical factors in the success of any business. In the Philippine market, where businesses are growing rapidly, especially in industries like retail, food, […]

Read moreCrispy Chicken Feet: Eula Paradero’s Budget-Friendly Filipino Street Food Success Story

When it comes to street food that resonates with the Filipino palate, chicken feet—affectionately known as “Adidas”—has long held a special place. Whether it’s for pulutan, ulam, or a quick […]

Read moreEffective Marketing Strategies for Networking Events

Events related to networking give great chances for companies to create leads, build strong relationships, and raise brand recognition. Still, turning up alone won’t optimize these advantages. Good marketing plans […]

Read more7 Ways Businesses Can Improve Customer Engagement

Customer engagement is the foundation of any successful business. Every interaction with a client could foster loyalty, confidence, and close bonds. In a crowded market, a company that regularly interacts […]

Read moreHow to Handle Price Increases Without Losing Loyal Customers

As a business owner, you know that pricing is a delicate balance. Setting prices too low might hurt your profit margins, while setting them too high could risk alienating your […]

Read moreAffordable Diamonds: How Charo Cordial’s Business Revolutionized the Jewelry Market

When we think of diamonds, we often associate them with luxury, opulence, and sometimes an unattainable price tag. The iconic phrase “diamonds are forever” has ingrained the idea that these […]

Read morePricing for New Businesses: How to Set Prices When You’re Just Starting Out

Introduction: Why Pricing Can Make or Break Your Business One of the most common struggles new business owners face is setting the right price for their products or services. It […]

Read more

Comments