Introduction Pricing is one of the most critical factors in the success of any business. In the Philippine market, where businesses are growing rapidly, especially in industries like retail, food, […]

Read moreCrispy Chicken Feet: Eula Paradero’s Budget-Friendly Filipino Street Food Success Story

When it comes to street food that resonates with the Filipino palate, chicken feet—affectionately known as “Adidas”—has long held a special place. Whether it’s for pulutan, ulam, or a quick […]

Read moreEffective Marketing Strategies for Networking Events

Events related to networking give great chances for companies to create leads, build strong relationships, and raise brand recognition. Still, turning up alone won’t optimize these advantages. Good marketing plans […]

Read more7 Ways Businesses Can Improve Customer Engagement

Customer engagement is the foundation of any successful business. Every interaction with a client could foster loyalty, confidence, and close bonds. In a crowded market, a company that regularly interacts […]

Read moreHow to Handle Price Increases Without Losing Loyal Customers

As a business owner, you know that pricing is a delicate balance. Setting prices too low might hurt your profit margins, while setting them too high could risk alienating your […]

Read moreAffordable Diamonds: How Charo Cordial’s Business Revolutionized the Jewelry Market

When we think of diamonds, we often associate them with luxury, opulence, and sometimes an unattainable price tag. The iconic phrase “diamonds are forever” has ingrained the idea that these […]

Read morePricing for New Businesses: How to Set Prices When You’re Just Starting Out

Introduction: Why Pricing Can Make or Break Your Business One of the most common struggles new business owners face is setting the right price for their products or services. It […]

Read moreSeasonal Merchandising Made Easy: Storage Tips for Retailers

Retail companies face a distinct set of difficulties when it comes to handling their seasonal inventory. Proper seasonal merchandising requires not just successful sales methods, but also smart storage solutions […]

Read moreHow Advanced Computing Is Revolutionizing Financial Modeling

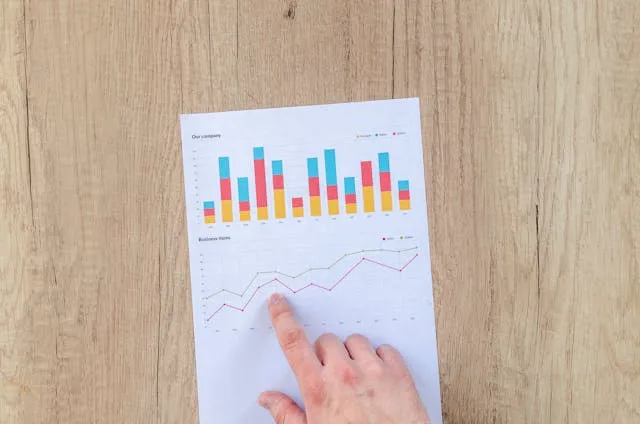

Thanks in great part to major developments in computing technology, financial modeling has changed remarkably recently. Once a subject dominated by simple computations and rudimentary spreadsheets, artificial intelligence, machine learning, […]

Read moreHow Crash Reports Can Help Urban Planners Make Improvements

Urban planning involves designing safer cities that are efficient and livable overall. Planners face a major hurdle in rendering traffic way safer by drastically cutting back on nasty accidents. Crash […]

Read more8 Creative Ways to Boost Your Business’s Efficiency

In today’s fast-paced business environment, efficiency is critical to success. Businesses with efficient operations, highest production, and lowest waste have a competitive advantage. The difficulty is in developing original and […]

Read moreHow Insurance Can Keep Your Business Running

Any company can be disrupted by unexpected difficulties, which also cause operational setbacks and financial strain. Staying prepared guarantees stability and long-term success when dealing with property damage, legal conflicts, […]

Read moreAlgorithmic Edge: Transforming Data into Profit

Data is today the lifeline of modern financial markets. As billions of data points are generated daily, making sense of this data is no mean task. Algorithmic trading has been […]

Read moreWhat Are the Most Durable Roofing Materials for Homes and Businesses?

More than just a protective cover, a roof is a necessary component of structural integrity, energy economy, and the lifetime of a building. The correct roofing material will help a […]

Read moreMRT-3 Assures Commuters: No Fare Increase Planned Amid LRT-1 Hike

Metro Rail Transit Line 3 (MRT-3) General Manager Michael Jose Capati has reassured passengers that there are no immediate plans to increase fares, even as the Light Rail Transit Line […]

Read more

Comments