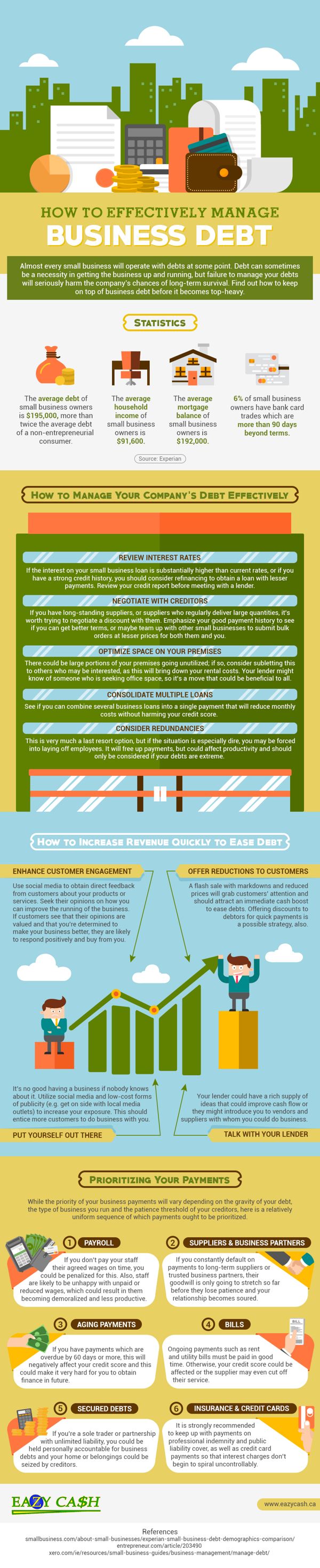

Almost every start-up business will have sizeable debts to carry in its first few months, so it’s vital that the owner learns how to keep that debt in check to avoid it stockpiling and becoming unmanageable. Experian research shows that the average small business owner has debts of $195,000, more than twice that of a typical non-entrepreneur.

Effective management of your company’s debts is crucial. If you have a strong credit history and a good relationship with several suppliers, it’s worth taking advantage of that goodwill by refinancing to obtain a loan with lower interest payments or negotiating improved terms with creditors. It’s also a good idea to see if you can consolidate a series of loans into one repayment so that monthly interest costs are reduced.

You may need a quickfire injection of cash, too, which could come about from holding a flash sale to increase custom or simply increasing your public presence. Some businesses simply don’t market themselves enough and fail to penetrate the consciousness of consumers.

If you run a small business and you’re challenged by the debt that you owe, this infographic from Eazy Cash is well worth reading. There comes a point where crucial decisions need to be made and this graphic should help with making the right ones.