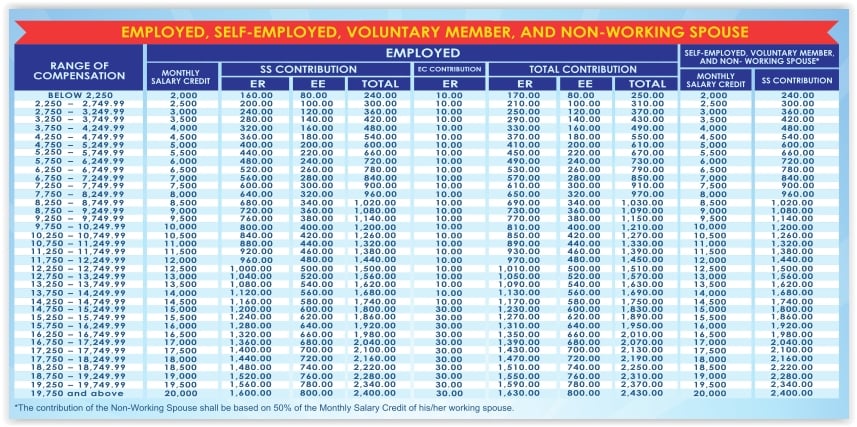

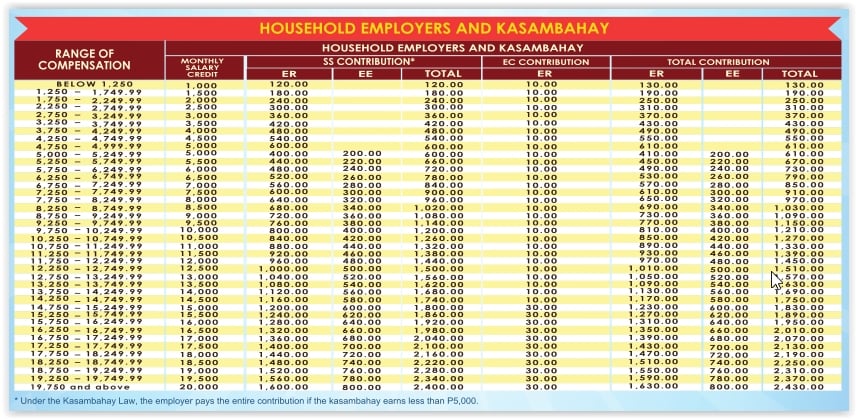

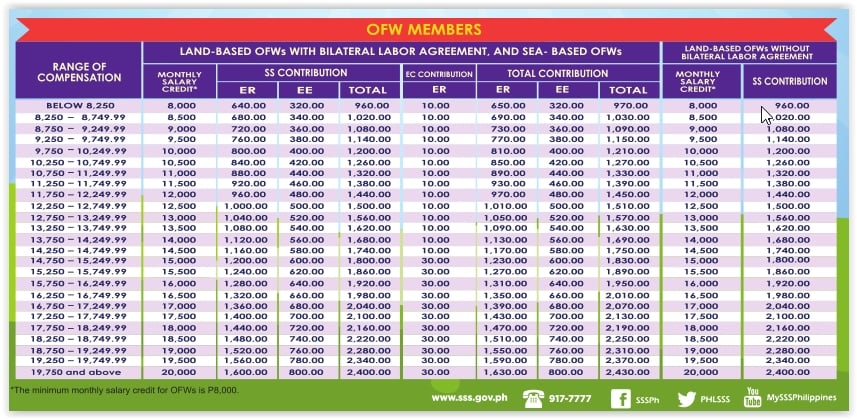

Here is an updated new SSS contribution schedule table effective April 2019 from Social Security System (SSS). The new SSS contribution schedule table is for every member of SSS especially for employers, employees, self-employed, voluntary (separated members) and OFWs.

It is important to be updated in the new SSS Contribution schedule table to avoid any payment errors in your contributions. As a member, you can check your SSS contributions online thru the SSS website https://www.sss.gov.ph for any updates regarding your SSS contributions.

Due Dates of Contributions

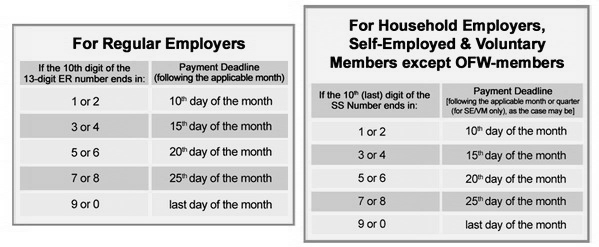

For Employed members

It is important that you are aware of the payment deadlines for contributions and member loans in order to avoid incurring penalties. If you are an employee-member, your employer must pay your contributions and member loans monthly in accordance with the prescribed schedule of payment which is according tothe 10th digit of the Employer’s ID Number. Late payments will result to penalties and delays in the processing of your benefits and loans.

The frequency of payment is on a monthly basis for business and household employers.

For Self-employed and Voluntary members

If you are a self-employed or a voluntary member, the prescribed schedule of payment is also being followed, (depending on the 10th (last digit) of the SE/VM SS number). However, the frequency of contribution payments for self-employed or a voluntary member can be on a monthly or quarterly basis. A quarter covers three (3) consecutive calendar months ending on the last day of March, June, September and December. Any payment for one, two or all months for a calendar quarter may be made.

For OFWs

Payment of contributions for the months of January to December of a given year may be paid within the same year; contributions for the months of October to December of a given year may also be paid on or before the 31st of January of the succeeding year.

Hi,

I’m an OFW and my last SSS payment was for March 2019. It’s Jan 2020 and I would like to pay my April to Dec 2019 contribution. I tried to generate PRN online but it wont let me. May I know if I can still pay this?