New SSS Rates 2025 | MPF & Employee Share

🔹 Effective Date: January 2025

🔹 Minimum MSC: ₱1,000.00

🔹 Maximum MSC: ₱35,000.00

🔹 Contribution Rate: 15% of Monthly Salary Credit (MSC)

SSS Contribution Changes for Household Employers & Kasambahay (2025 Update)

The Social Security System (SSS) has announced new contribution rates for household employers and kasambahay, effective January 2025. These changes ensure better social security benefits for domestic workers while aligning with Republic Act No. 11199 (Social Security Act of 2018).

Key Updates for 2025:

✔ Higher Contribution Rate: 15% of Monthly Salary Credit (MSC)

✔ Expanded Salary Brackets: ₱1,000.00 to ₱35,000.00

✔ Mandatory Provident Fund (MPF) Contributions for salaries above ₱20,000.00

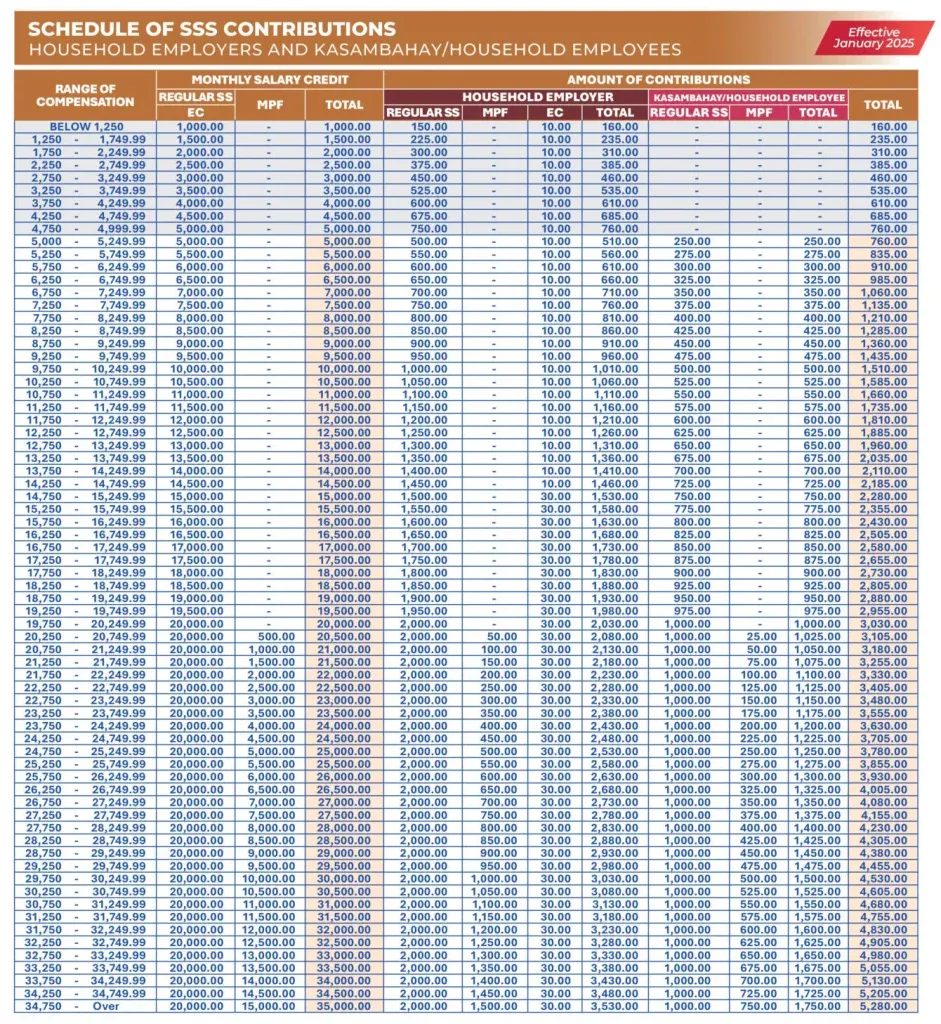

New SSS Contribution Table 2025 for Household Employers & Kasambahay

The following table outlines the updated contribution rates for household employers and kasambahay, effective January 2025:

👉 Important Note:

- Household employers are responsible for paying the full SSS contribution for their kasambahay if the monthly salary is below ₱5,000.00.

- If the salary exceeds ₱20,000.00, the Mandatory Provident Fund (MPF) contribution applies, where the kasambahay shares part of the cost.

Key Takeaways for Household Employers & Kasambahay

For Household Employers:

✔ You must register your kasambahay with the SSS and remit monthly contributions.

✔ If your kasambahay earns below ₱5,000.00, you must pay the full contribution.

✔ If the salary is above ₱20,000, the kasambahay will contribute a portion to the MPF.

✔ Non-compliance may result in penalties or legal consequences.

For Kasambahay (Household Workers):

✔ Your employer must pay your SSS contributions if your salary is below ₱5,000.00.

✔ If your salary is above ₱20,000, you will need to contribute to the MPF program.

✔ SSS membership ensures retirement, disability, maternity, and other benefits.

Benefits of the New SSS Contributions for Household Workers

How Your Benefits Are Computed

- Retirement, disability, sickness, maternity, death, and unemployment benefits are based on the Monthly Salary Credit (MSC).

- Contributions exceeding ₱20,000 go into the MPF Program, which serves as a savings and investment for members.

- Higher contributions mean higher pensions and financial security for kasambahay.

When Will the New SSS Contributions Take Effect?

📌 January 2025 – The new SSS contribution rates for household employers and kasambahay will take effect following publication in a newspaper of general circulation and registration with the National Administrative Register.

Final Thoughts: Why This Update Matters for Household Employers & Kasambahay

This increase in SSS contributions ensures better financial security for kasambahay and domestic workers. Household employers must comply with the new SSS contribution table for 2025 to avoid penalties and legal issues.

✅ Kasambahay get better social security benefits

✅ Household employers must adjust payroll deductions

✅ SSS contributions = bigger pensions & future savings!

Frequently Asked Questions (FAQs) About SSS Contributions for Kasambahay (2025 Update)

What is the new SSS contribution rate for kasambahay in 2025?

The new SSS contribution rate is 15% of the Monthly Salary Credit (MSC).

Who pays for the kasambahay’s SSS contributions?

If the salary is below ₱5,000, the household employer pays the full amount.

If the salary is above ₱5,000, the kasambahay shares the contribution.

What is the MPF (Mandatory Provident Fund)?

The MPF Program is a savings & investment fund where SSS contributions above ₱20,000 are allocated for future financial security.

What happens if a household employer doesn’t pay SSS contributions?

Employers may face penalties, fines, or legal consequences for failing to remit SSS contributions for their kasambahay.

How can I register my kasambahay for SSS?

You can register online at www.sss.gov.ph or visit the nearest SSS branch.

Need More Information?

Visit the SSS website or contact your local SSS branch for more details.