NVIDIA Corporation (NASDAQ:NVDA) is an American tech giant founded in 1993 by Jensen Huang, Chris Malachowsky, and Curtis Priem. Despite its humble beginnings, the company has skyrocketed to colossal heights in the tech world.

NVIDIA’s capitalization history is a tale of relentless innovation, savvy market expansion, and strategic decision-making. Initially, the company carved its niche in developing graphics chipsets for gaming PCs, gradually capturing the hearts of gamers and developers alike. The pivotal moment arrived in 1999 with the GeForce 256 graphics card launch, heralding NVIDIA’s dominance in the graphics card market and propelling its revenue and capitalization to new heights.

Going public in January 1999 marked another milestone for NVIDIA, with shares initially priced around $12 each. In the ensuing years post-IPO, the company’s capitalization witnessed steady growth, mirroring the increasing sales and popularity in the market.

A significant turning point for NVIDIA occurred in the early 2010s with the explosive rise of the mobile device market and the emergence of machine learning and AI technologies. Expanding beyond gaming, NVIDIA’s GPUs found a perfect fit in parallel computing, crucial for AI and deep learning applications. This diversification opened up fresh revenue streams in markets like image recognition, natural language processing, and autonomous vehicles.

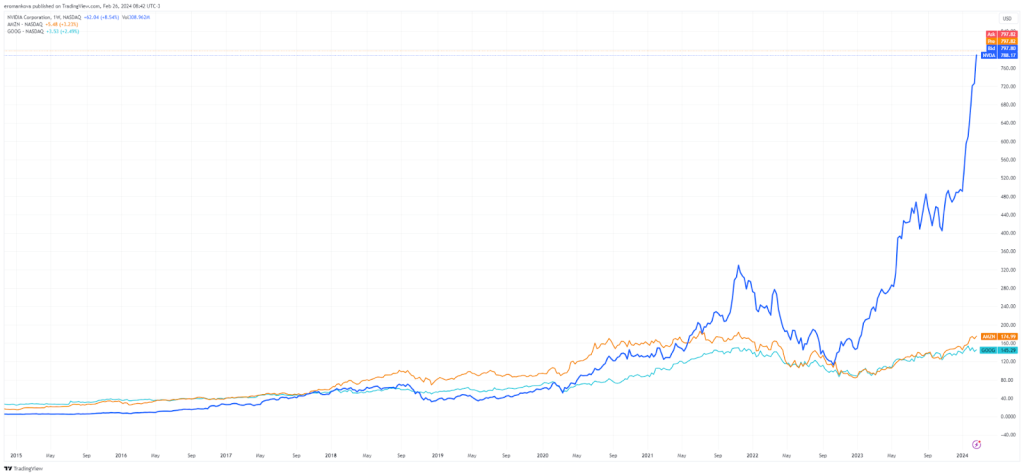

By 2016, NVIDIA stock soared from $32 to $106 in a single year. Its capitalization tripled, driven by the surge in demand for cloud computing, artificial intelligence, and gaming.

Fast forward to mid-2020, and NVIDIA breached the $300 billion mark in market capitalization. Introducing new products like automotive industry chips for cloud computing and expanding its GPU market presence further fueled its growth.

The ongoing buzz surrounding artificial intelligence technologies has propelled the GPU developer into the ranks of top-tier companies in the United States. NVIDIA’s savvy bet on the surging demand for AI technology has driven an astounding 265% increase from a year ago. The release of Nvidia’s Q4 earnings report on February 21 marked its third consecutive quarter of record-breaking profits and sales. Moreover, for fiscal 2024, the company witnessed a staggering 126% surge in full-year revenue, reaching $60.9 billion. This impressive performance has propelled NVIDIA’s market capitalization beyond that of both Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOG).

However, NVIDIA’s journey hasn’t been without its share of challenges. Fluctuations in GPU demand, global economic crises, and stiff competition from rivals like AMD and Intel have tested its resilience. It seems that the fervor surrounding AI is the main catalyst for Nvidia’s skyrocketing stock prices. As long as Nvidia retains control over the limited chip supply, the momentum of demand will likely uphold the narrative of ongoing upward growth.