In the ever-evolving landscape of online casinos, having a secure and efficient payment method is paramount. GCash has garnered immense popularity in the country due to its convenience and versatility. As a mobile wallet, it allows users to easily transfer funds, make payments, and even shop online, all from the comfort of their smartphones.

When it comes to online casinos, the speed and security of transactions are critical. GCash excels in this regard, offering lightning-fast deposits and withdrawals. This not only enhances the gaming experience but also provides peace of mind to players knowing their financial data is secure.

This comprehensive guide will delve into why GCash has become the preferred choice for many casino enthusiasts in the Philippines. We’ll explore the top casinos that seamlessly integrate with GCash, discuss the advantages of using this payment method, and offer tips to make your online casino experience even more enjoyable.

What is GCash?

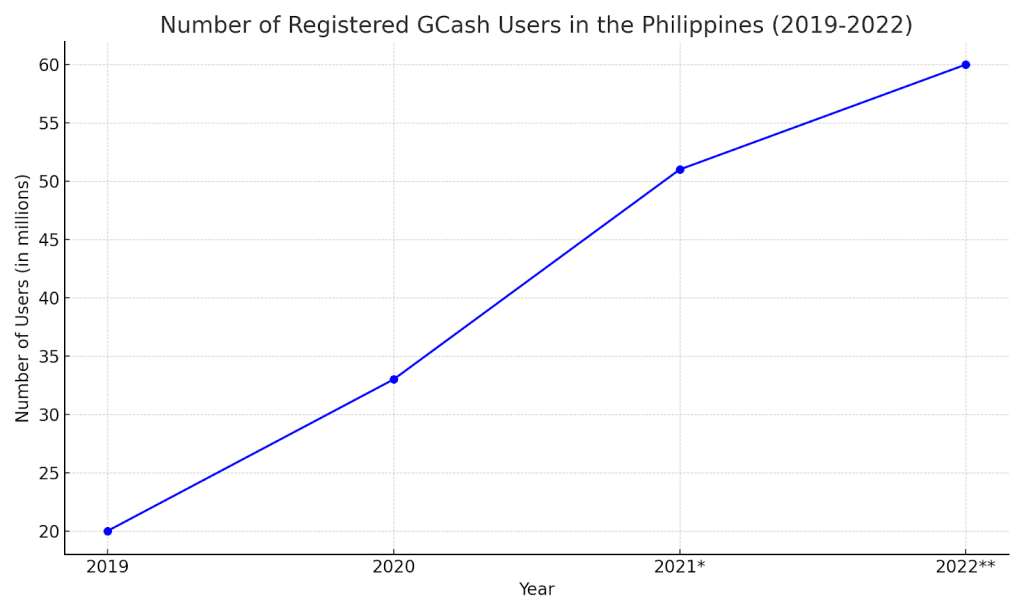

Inspired by real-life success stories, such as that of Cocoy Rubio who transitioned from a bartender to a business owner, GCash operates under the slogan “Kaya Mo. I-GCash mo.” Meaning “You can do it. Use GCash for it,” this platform has empowered millions. By March 2022, GCash had a remarkable 60 million users, representing around 83% of the adult population in the Philippines.

With partnerships with 4.5 million merchants, its impact is undeniable. If you’re looking for the best list of online casino in the Philippines with GCash, our experts have identified the top platforms that offer GCash as a payment method. Learn how to download GCash and use it for online transactions at casinos. As a result, it promises both security and convenience, making it a prime choice for online casino Philippines GCash interactions.

Setting Up a GCash Account

Setting up a GCash account is a straightforward process. Use this opportunity to enjoy the benefits of this popular e-wallet in the Philippines.

1. Download the App: Begin by downloading the GCash app from your device’s respective app store. Whether you’re on Android or iOS, the app is readily available for free.

2. Enter Your Mobile Number: Once the app is installed, open it and input your phone number. Make sure that the number you provide is active as you’ll receive an authentication code via SMS.

3. Authenticate with the SMS Code: After entering your mobile number, you’ll receive an SMS containing a unique authentication code. Enter this code into the app to verify your identity.

4. Provide Personal Information: The next step requires you to fill in your personal information. This includes details such as your name, address, and email.

5. Set Up a Security MPIN: For added security, you’ll be prompted to create a 4-digit MPIN (Mobile Personal Identification Number). This MPIN will be used for future logins and transactions, so it’s crucial to remember it. For enhanced security, avoid using easily guessable numbers like “1234” or your birth year.

6. Submit Valid Identification for Verification: To fully activate your account and enjoy all its features, you’ll need to undergo a verification process. This involves submitting a valid identification document.

Depositing Money with GCash

Depositing funds into your GCash wallet is an uncomplicated process.

1. Access Your GCash App: Start by opening your app on your device.

2. Navigate to the ‘Cash In’ Option: On the main dashboard, look for the ‘Cash In’ option and select it. This is the primary method to add funds to your wallet.

3. Choose a Cash-In Method: GCash online provides a variety of ways to deposit funds. You might see options related to online banking, remittance centers, and over-the-counter services.

4. Enter the Deposit Amount: After selecting a cash-in method, input the amount you want to deposit. Remember that the entered amount should not exceed any limits set by GCash.

5. Confirm and Complete Transaction: Once you’ve specified the amount, you’ll be asked to review and confirm the details. Upon confirmation, follow the provided instructions specific to the cash-in method chosen.

6. Wait for Confirmation: After completing the deposit process, wait for a notification or SMS confirming that the funds have been added to your wallet.

Withdrawing Winnings with GCash

Withdrawing your winnings or funds from your GCash account is a simple task.

1. Access GCash App: Open the app on your device.

2. Execute GCash Login: Input your credentials to perform a GCash login. This step is vital to access your account and initiate the withdrawal.

3. Locate the ‘Cash Out Option: On the main dashboard of the app, find and select the ‘Cash Out’ option. This is the primary pathway to withdraw funds from your account.

4. Select a Withdrawal Method: Different payment options will be presented to you for withdrawing funds. Choose the method most suitable to your needs.

5. Specify Withdrawal Amount: Indicate the amount you wish to withdraw. Remember to double-check the amount before proceeding.

6. Confirm the Transaction: Confirm the transaction to initiate the withdrawal.

7. Wait and Collect: Depending on your chosen withdrawal method, there might be a waiting period. For instance, over-the-counter withdrawals may require you to visit a physical location to collect your cash. In such cases, follow the instructions provided by the app.

Comments:

- Always log out from your login after completing transactions to maintain account security.

- Keep an eye on transaction notifications or SMS alerts to stay updated on the status of your withdrawal.

- If you encounter any issues during the withdrawal process, it’s advisable to contact GCash customer support for assistance.

Understanding the Benefits of GCash Transactions

GCash has emerged as a leading choice for millions, offering numerous advantages tailored to the modern user’s needs. Let’s dive into the distinct benefits GCash brings to the table.

Wide Acceptance

Beyond its widespread domestic use, GCash extends its services globally through the GCash Overseas feature. Whether you’re a Filipino citizen using a Philippine-issued SIM or a non-Philippine-issued one, GCash ensures its functionality remains unhindered.

Convenience and Accessibility

GCash is a way to simplify financial tasks. Whether you’re transacting locally or trying to send money from abroad, GCash has streamlined its processes. For overseas Filipinos, it provides a suite of services, from sending money to bank transfers, all tailored to their needs.

Fast Transactions

When it comes to digital transactions, speed is paramount. GCash delivers on this front by offering real-time deposits, ensuring users have access to their funds or continue with their payments without needless waiting.

Cost-effectiveness

Digital transactions sometimes come with hidden costs. With GCash, transparency is key. While certain methods of cashing into GCash might come with fees, the platform is clear about these charges. For instance, over-the-counter cash-ins are free until a monthly limit of PHP 8,000. Beyond this, a minimal fee is applied. For a detailed breakdown of fees, users usually refer here.

Anonymity and Privacy

GCash respects user anonymity and has put measures in place to protect user data. Transactions are encrypted, and security features like Two-Factor Authentication and biometric authentication options are integrated. This ensures that user details remain confidential and that their financial activities are shielded from prying eyes.

Security

Digital security is of paramount importance, especially in the realm of financial transactions. GCash prioritizes the safety of its users and has established a multi-layered security framework to protect against potential threats and unauthorized access.

MPIN Authorization

The MPIN (Mobile Personal Identification Number) is a unique 4-digit code set by the user. This pin acts as the first line of defense, as it’s required for logging in and authorizing transactions.

Biometrics Login

To fortify security further, GCash offers the option of biometric authentication. This feature leverages the user’s unique biological traits, like fingerprints or facial recognition, to validate their identity.

Two-Step Verification

Two-step verification, commonly known as Two-Factor Authentication (2FA), is another pivotal security feature on GCash. It necessitates a second level of authentication beyond the MPIN.

FAQ about GCash

Can I use GCash for Casino Transactions Outside the Philippines?

Yes, GCash can be utilized for casino transactions outside the Philippines. As long as you’re a Filipino citizen with a Philippine-issued or Non-Philippine-issued SIM, you have access to GCash services abroad.

Do I need to pay fees for GCash casino transactions?

While GCash itself may not charge fees for all transactions, certain casinos might impose transaction fees for deposits or withdrawals.

Can I register more than one GCash account?

No, each individual is allowed to have only one account tied to their unique identity and contact details.

How long does it take to deposit with GCash on my casino account?

Deposits made via GCash are typically processed in real time. However, the exact duration might vary depending on the casino’s processing times.