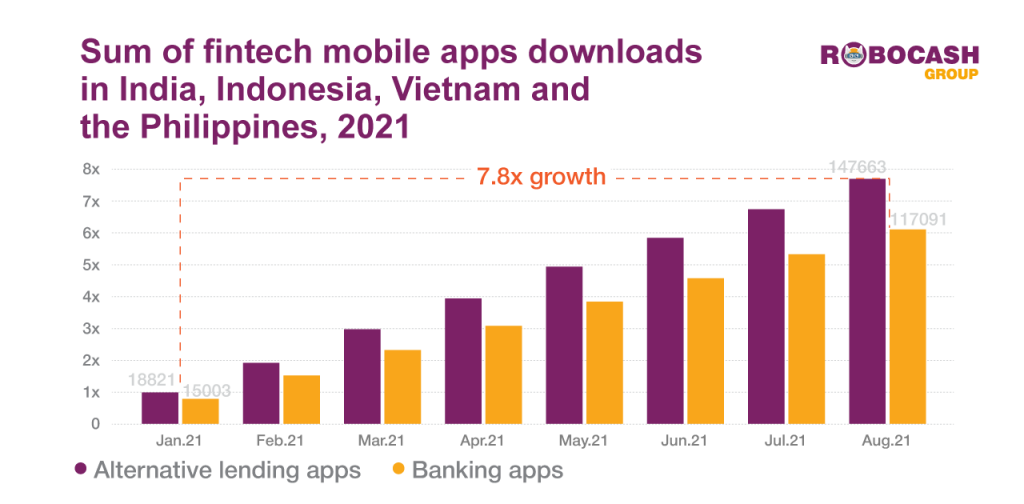

From January to August 2021, South and Southeast Asia had seen significant growth in popularity of banking and alternative lending apps. India, the Philippines, Indonesia, and Vietnam observed a 7.8x rise in downloads for banking and alternative lending apps, the research conducted by Robocash Group reveals.

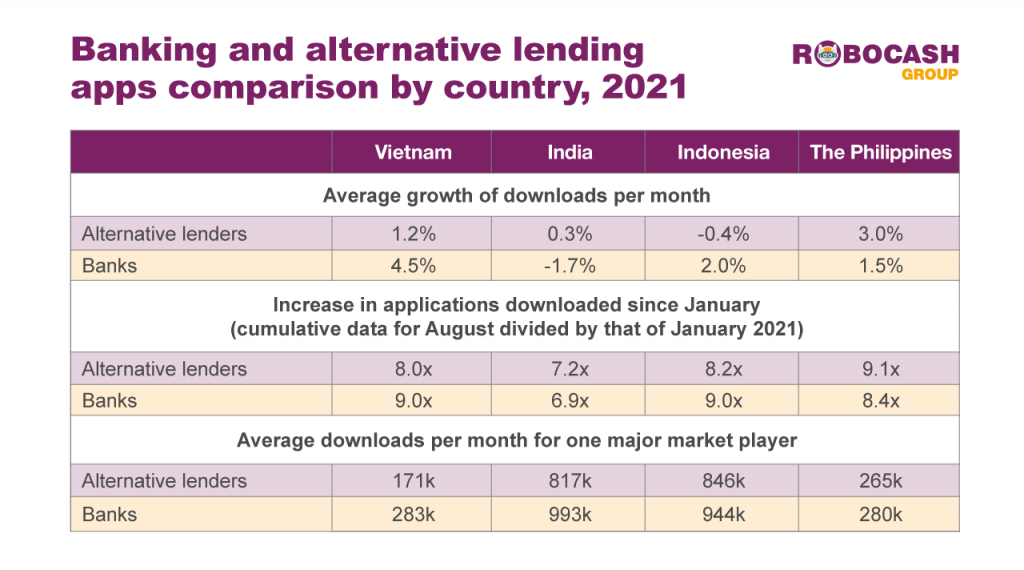

The fastest 9x growth in the number of downloads of alternative lending apps is seen in the Philippines. Indonesia and Vietnam are the major countries with a 9-fold increase in downloads of banking apps. Downloads of banking and credit apps have also surged in India, but with a lower rate relative to other countries, seven times since January.

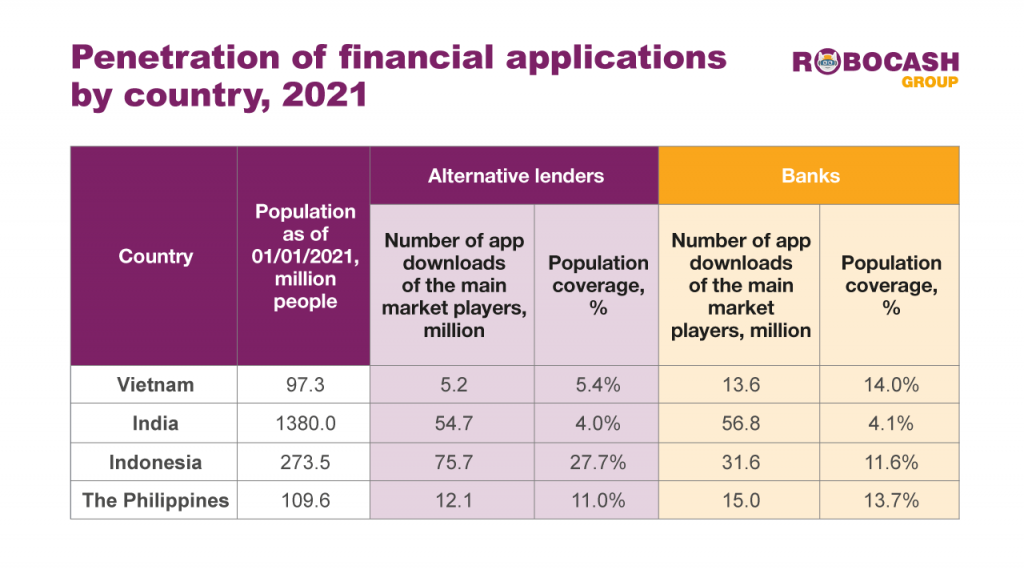

The pandemic has led to a surge in fintech penetration, but the population coverage is still low and demand remains unexploited. In 2021, 5.4% of Vietnam’s population downloaded alternative loan apps and 14% of the population downloaded banking applications. In the Philippines, a similar share of 14% of the population downloaded banking apps and 11% – other credit applications. Indonesia has the highest demand coverage by alternative lenders, reaching 27.7% of the population.

Growing popularity of apps that grant access to financial services is rooted in global digitalisation, bolstered by the COVID-19 pandemic.The increasing availability of online financial services from banking and non-banking companies and the growing interest of consumers are expected to expand even further in the near future.