Walking into the world of trading can be hard. This is especially true for beginners who may mess up and slow down their progress. They might trade too much or forget to use stop-loss orders. These common missteps can lead to big losses and frustration. This blog post shares seven common errors that new traders often make. It also provides useful tips on how to stay away from them. Knowing about these pitfalls and using the right plans can improve your trading skills. It helps you make better decisions, setting you up for success in the market over time.

Overtrading

For beginning traders, overtrading is a common mistake that frequently leads to emotional decisions and losses. Traders who do too many trades without a clear strategy run this risk. Start by developing a thorough trading plan including your objectives, risk tolerance, and techniques to help avoid this. Follow your plan exactly and fight the need to trade impulsively, driven by temporary emotions. Following a disciplined strategy and concentrating on well-researched deals helps you to keep control over your trading activity and lower your chance of losses. Remember, in trading, less can often be more; excellent trades are more important than regular, unplanned ones.

Lack of Patience

In trading, patience is absolutely important; nonetheless, many beginning traders, when they get rapid gains, engage in risky behavior. This irritation could cause bad decisions and losses. Rather, concentrate on laying a solid basis for your trading plan and realize trading is a long-term activity. Though the procedure takes time and effort, profits might not arrive right away. By developing patience, you let your plans develop organically and prevent acting quickly, which can compromise your trading performance. Accept the learning and development road in trading; keep in mind that it is a marathon rather than a sprint.

Not Using Stop Loss Orders

One major error that increases your risk of major losses is neglecting stop loss orders. To reduce your possible downside, a stop-loss order automatically sells an asset at a designated price. Using stop losses guarantees that you do not hang onto losing situations for too long and helps guard your funds against significant losses. To properly control risk, always include stop loss instructions in your trading plan. This approach protects your investments and helps you keep your trading losses under control so that you may concentrate on generating lucrative trades free from concern about large losses.

Overconfidence after Profits

A winning run might cause overconfidence, which is a risky attitude in trading. Overconfident people could start making hasty, ill-considered judgments, thinking success would last forever. Your judgment may be distorted as a result, and you risk major losses. Whatever achievements and profits you have made, be sure to always follow your trading plan and keep a cool mind. Examine every trade depending more on its advantages than on past success. Staying grounded and disciplined helps you escape the traps of overconfidence and make more logical, strategic judgments, therefore guaranteeing long-term trading success.

Letting Emotions Impair Decision-Making

Your trading decisions might be seriously influenced by emotions such as exhilaration or despair, thus affecting the results. When people trade based on their feelings, they might stray from their carefully made trading plan. This could lead them to make quick, unplanned choices. To avoid this, base your trading decisions on objective factors and thorough study instead of emotions. When you control your emotions and base your choices on data, you get better at making sound decisions. This gives you a better chance of success in trading and helps you manage risk more effectively.

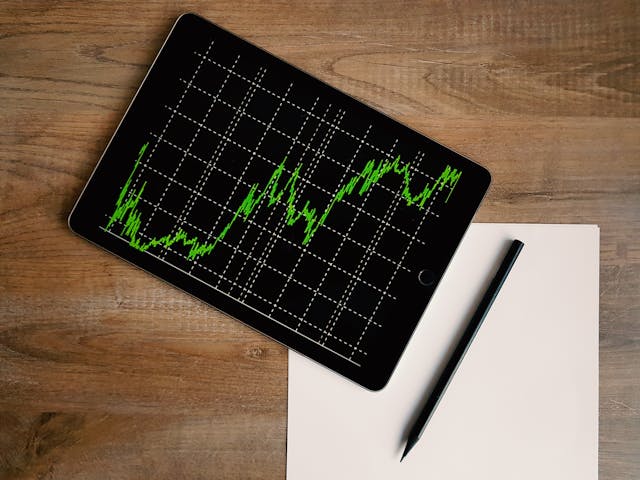

Inadequate Setup for Trading

Success and efficiency in trading depend on a well-ordered system. To make quick deals, be sure to use trading computers that are dependable and speedy with a consistent internet connection. If at all possible, track charts, news feeds, and trading systems concurrently using several monitors. Purchasing tools and excellent trading software will improve your decision-making and analysis approach. Make your workplace comfortable, and do not have any major distractions to support concentration and output. A proper setup not only increases general trading performance but also helps you execute transactions more precisely and lowers the possibility of mistakes.

Overleveraging

For rookie traders especially, using too much leverage increases both gains and losses, therefore increasing risk. When you use leverage, you can make big trades with little money, but if the market doesn’t go your way, leverage can make your losses much bigger, too. To properly control risk, especially when you are beginning, keep to smaller leverage ratios. Know that leverage is a great instrument that has to be applied sensibly. You may guard yourself against significant losses and create a more steady trading approach by keeping leverage at a reasonable level and only utilizing it when you completely understand its consequences.

Conclusion

Making it big in the market means staying away from common trading mistakes. If you lower your risk level, be patient, and use stop-loss orders, you can keep your money safe. At the same time, this could help you make smarter choices. However, being too sure of yourself can hurt your chances of success. Also, remember that making decisions based on emotions or without enough knowledge is not good for business. You must stick to a strict approach and keep learning new things. Doing this will create a solid starting point for you in the market.