A survey conducted by Robocash Group among the Filipino borrowers has shown that online lending plays an important role for them. 58% also mentioned that they were planning to take another loan for a bigger amount in the near future.

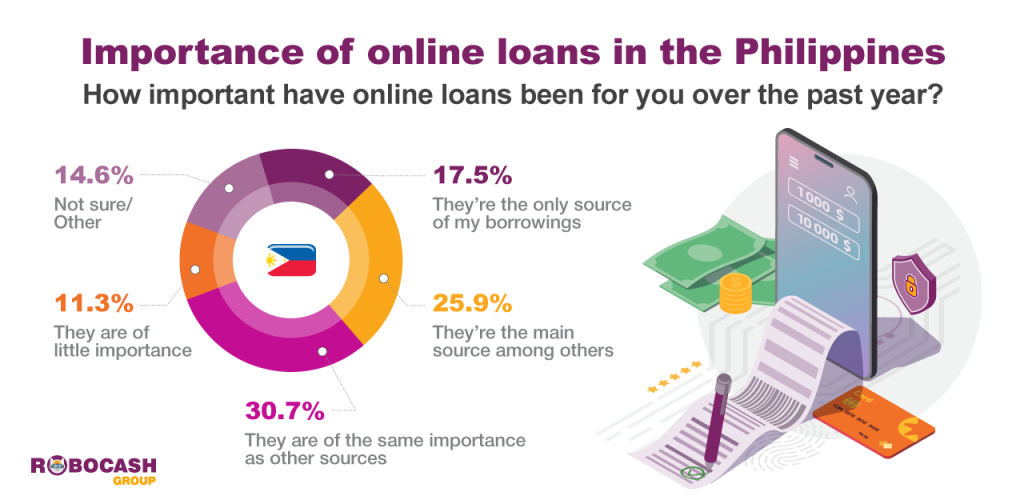

Three out of four respondents indicated that online loans have been at least as important for them as other sources of borrowings over the past 12 months. At the same time, 26% named them the main source of borrowings, and 17.5% – as the only one.

The main reasons for choosing such loans is a fast transfer of funds and easy application process. These advantages were indicated by 33% and 32% of respondents respectively.

Interestingly, the goals of online loans have changed over the past 6 months. The respondents started borrowing more for unforeseen expenses (24%), payments for bills (24%) and medicines (20%) – that is, for the most urgent needs. Other options – groceries, non-food products and entertainment – gained much less votes, ranging from 0.5% to 4%.

As for the near future, 58% of those surveyed said that they planned to take an online loan for a larger amount than before. Analysts of Robocash Group believe that on the one hand, this is a result of the accumulated underconsumption caused by the pandemic. But on the other hand, it is also an important indicator that the situation has been stabilizing and life is returning to its usual course. Gaining more confidence in the future, the people are ready to spend more for their needs.

The survey was conducted by Robocash Group in March 2021 and involved 920 respondents in total.

________________

ABOUT

Robocash Group is a group of companies, which provides fintech services in Asia and Europe. Founded by entrepreneur Sergey Sedov in 2013, the group focuses on alternative consumer lending and marketplace funding. All products of the group are built completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business. For the time of operation, the group has gained more than 12 million customers and provided financing in the amount of 1 billion USD.