Looking to start a family soon? It’s no secret that building a future with your partner requires a lot of financial preparation. Other than handling short-term expenses such as rent and utilities, you need to take your children’s education and other big investments into account, too. As you continue to plan for the long run, one thing you must provide is a safety net for your loved ones.

One of the best ways you can protect your family is to purchase a comprehensive insurance policy. In case of your complete disability or untimely death, having the necessary coverage will grant your loved ones the breathing room they need to cope. Thanks to significant advancements in the financial sector, you and other like-minded investors have no shortage of options to choose from.

Nowadays, you can purchase a health insurance plan that’s paired with an investment component, flexible payment terms, and other enticing perks. But given the vast array of products at your disposal, you may have some trouble identifying the best policy for your loved ones.

4 Important Things to Consider When Buying Insurance for the Family

If this is your first time purchasing an insurance plan, taking note of these factors will help you find the best investment possible.

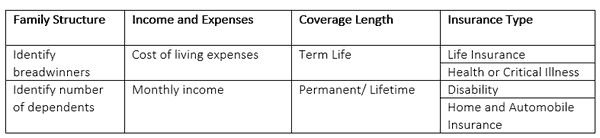

- Family Structure

Do you and your spouse plan to have kids? Are you currently taking care of your parents? Are you working abroad, away from your family? Before you start looking at different insurance plans, the first thing you should do is review your family’s structure.

As a rule of thumb, always remember that covering more people will mean spending more money. Having everyone insured is a great thing, but if you’re already walking a financial tightrope, it may not be the best option to take. Fortunately, you can solve this dilemma by looking at the roles of your family members.

Knowing who the breadwinners and dependents are will help you prioritize your coverages. Generally speaking, you should look to insure the ones sustaining the family since their death may lead to financial strain.

- Income and Expenses

Acquiring a family insurance plan means that you’ll have another set of responsibilities on your plate. Since you’ll be making periodical payments, you’ll need to project your cost of living expenses and budget your income accordingly. If you’re also managing through debt, efficiently splitting your earnings will make it easy for you to fulfill your financial obligations.

- Coverage Length

Coverage or term length is another critical factor that can significantly affect your investment. Along with your age and the benefits you wish to avail of, your plan’s length will also determine the premiums you’ll have to pay. While terms may vary depending on the provider, there are two main types available:

- Term Life Insurance – This option provides coverage for a limited period. You can make fixed payments like any other plan and end your policy once your child is no longer dependent on you.

- Permanent or Lifetime Insurance – As the name suggests, this type of plan offers lifelong coverage. These policies can potentially grow your savings but are generally more expensive than its counterpart.

- Insurance Type

The last thing to do would be to look at the different kinds of insurance. Each type is engineered to serve a specific function, and having a better understanding of each will allow you to maximize your purchase.

- Life Insurance

Life insurance will provide financial relief to your family in the event of your death. Once you pass away, your loved ones will be compensated by your service provider, granting them protection even after you’re gone.

In addition to your death benefit, you can also use a life insurance policy as a savings plan. Once your cash has grown, you can easily withdraw the money you’ve invested.

Learn more: A Step by Step Beginner’s Guide to Life Insurance in the Philippines

- Health or Critical Illness

If critical illnesses such as cancer run in your family, a health insurance plan will come in handy. Getting your loved ones covered will help you offset any medical expenses that may come your way. Since medical bills can be quite overwhelming, acquiring one will prevent you from draining your savings or resorting to a loan.

- Disability

Disability insurance tends to get overlooked by many. While you may be in good health, an accident on the road, at home, or at work can catch you when you least expect it. Getting disabled and being unable to do daily tasks will greatly diminish your quality of life, so you should look to get covered.

Luckily enough, disability insurance will help you offset expenses caused by your injury and bring about other bonuses.

- Home and Automobile Insurance

Don’t forget to protect your assets as well. Home damage from natural calamities or sudden breakdowns on the road won’t just dent your savings; it will also cause a great deal of stress. Instead of paying for costly repairs on your own, getting your house and car insured is a cheaper option.

Final Takeaways

Purchasing an insurance plan for the first time can be intimidating. Since it entails spending a great deal of money, it’s no surprise why many people are reluctant to purchase one. But now that you’re aware of the points above, buying the right insurance plan should be easier.