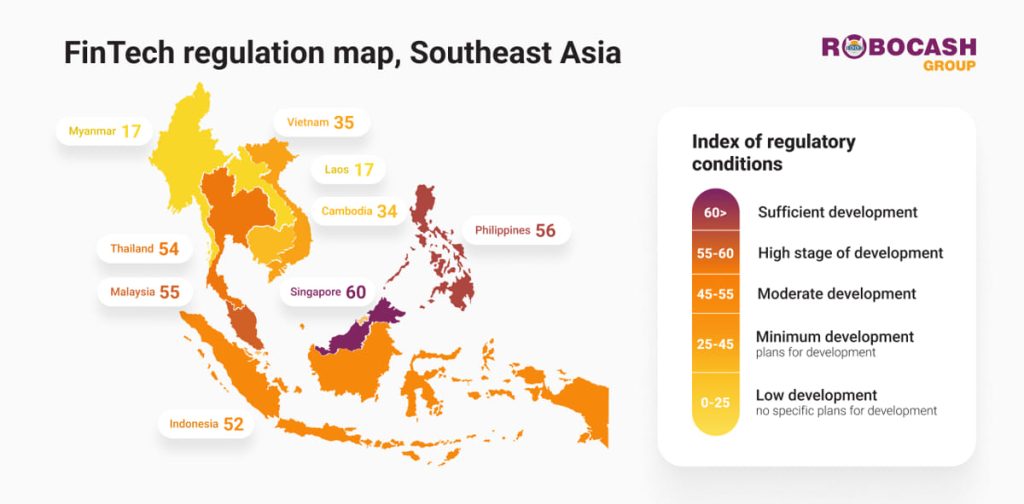

A tightly-knit group of Philippines, Malaysia, Thailand and Indonesia are following closely behind Singapore. Singapore continues leadership in FinTech regulation in Southeast Asia, affirmed by the analysts of Robocash Group.

Singapore | November 15, 2022 — A comparative picture of national FinTech regulation in the countries of Southeast Asia is based on the sum of 13 criteria based on the public information – availability in the country of special FinTech laws & acts, sandboxes, government initiatives, etc. (full list of criteria is described below). Singapore remains the undisputed leader in Southeast Asia’s FinTech regulation. The Philippines, Malaysia, Thailand and Indonesia are making swift progress. Vietnam falls behind but is forecasted to strengthen the FinTech regulation in the near future.

In general, the regulatory landscape of Southeast Asia is already approaching a singularly high saturation and will become evenly distributed further next year.

Singapore (score 60). Being a regional FinTech hub, Singapore leads in the field of FinTech regulation, serving as a kind of benchmark. National regulation is distinguished by a productive history of the sandbox established back in 2016, a developed regulatory landscape in relation to individual FinTech areas. Singapore features a whole list of efficiently working frameworks and core projects, overall high activity within several national projects and strategies, and an active local FinTech association.

Philippines (score 56). The Philippines is confidently pushing for the leadership position, surpassing Singapore in certain areas (the e-money regulation and other FinTech areas). Upon the development of FinTech sandboxes and open banking, the country may yet become a new regional leader. In fact, the Philippines is already on its way to meet this prerequisite: both directions are in the process of active development.

Malaysia (score 55). Malaysia demonstrates a similarly high development level of FinTech regulation. The country’s notable features are the setting of FinTech as one of the national priorities, as well as the overall proactivity when it comes to everything FinTech.

Thailand (score 54). Thailand is just marginally short of making the Top-3. The country has a very rich history of FinTech development – it was here that the first crypto-currency regulation regime in the mainland of Southeast Asia was introduced; the transition to e-money licensing was carried out back in 2004-2008, etc. There are three main regulators (BoT Central Bank, SEC regulatory agency, insurance regulator OIC), and as many as 5 FinTech sandboxes.

Indonesia (score 52). Indonesia has come a long way in terms of FinTech regulation. This is facilitated by the presence of two base regulatory bodies – the Central Bank of the Bank of Indonesia and the OJK regulatory department, which, for one, entails the parallel operation of two FinTech sandboxes. With a comparable level of development across most criteria, online banking regulation and customer identity initiatives remain potential hotspots for growth.

Vietnam (score 35). Currently, the regulatory field in the country can not be identified as developed. However, there is rapid progress (for example, beginning of e-money regulation in 2021, efforts to organise a national FinTech sandbox, etc.), which leaves no doubt that the country will noticeably strengthen in this regard in the near future.

Cambodia (score 34). The local achievements rightfully include the developed regulation in the field of Payments & Transfers, a whole system of FinTech associations, and the bold experience of implementing the national digital currency Project Bakong. However, local regulation obviously still has a long way to go.

Laos, Myanmar (score 17, each). These countries are only beginning their journey towards full-fledged FinTech regulation. Although, some national initiatives are likely still hidden from the global community.

The ranking of countries is based on the translation of the 13 public-information-based criteria:

1. Sandbox — FinTech sandboxes. Notably, if there is just one significant project operating in the country, it equates to the value of “3”, while if there are several – to “4”;

2. Special Fintech Laws & Acts — the presence of a developed legislative FinTech landscape in the country (cumulative assessment);

The Regulatory group of 6 criteria. A score of “4″ means that the industry is clearly regulated at the official level with the issuance of special licences.

3. The level of official regulation of Online Banking;

4. E-money (electronic and mobile money and wallets);

5. Payments & Transfers (digital payments and transfers);

6. Alternative Lending (alternative lending, incl. P2P lending, crowdfunding, online micro-lending, etc.);

7. Blockchain/Cryptocurrency;

8. Others (other FinTech areas: brokerage, online insurance, digital currency exchange, etc.).

9. Frameworks — the presence of national regulatory and technologically unified spaces in the areas of open banking, data protection, cybersecurity and others;

10. Identification, NYC — the development of national systems of personal authentication and identification;

11. Associations — presence in the country of one (“3”) or more (“4”) active FinTech associations, including self-regulatory ones;

12. Strategies — availability of long-term state programs for the development of FinTech;

13. Initiatives — existence of other significant government FinTech initiatives.

About Robocash Group:

Robocash Group is a group of companies, which provides fintech services in Asia and Europe. Founded in 2013, the Group focuses on providing technological finance solutions for the underserved by the traditional banking system. All products of the group are built completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business. For the time of operation, the Group has gained more than 24 million customers and provided financing in the amount of 2.7 billion USD.