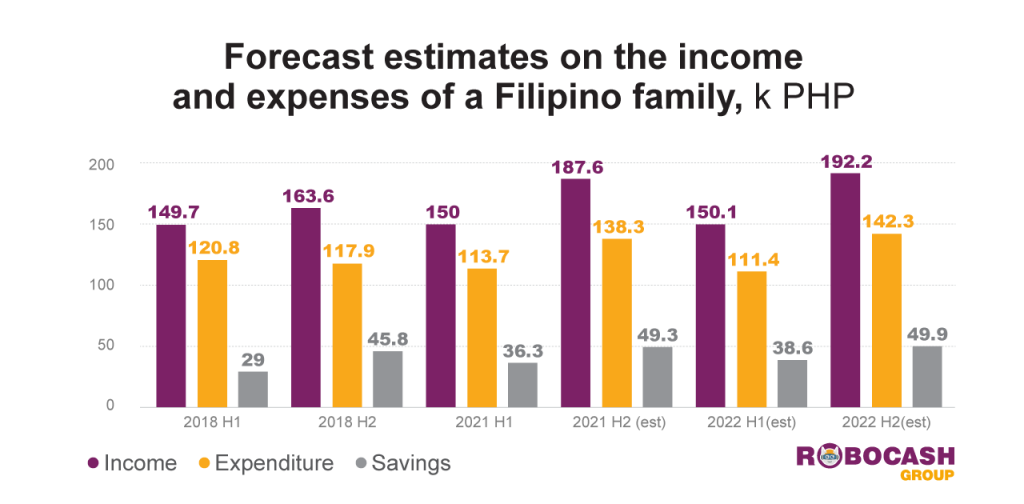

The positive difference between income and expenses has grown by a quarter in three years. As the average Filipino household’s income had hardly increased, the savings were formed largely due to reducing costs, supported by a number of contributing factors, revealed by the analysts of Robocash Group.

Robocash Group analysts estimate that in the second half of 2022, the average monthly income of a Filipino household was 188k PHP (3.7k USD), expenses – 138k PHP (2.7k USD), providing 49.3k PHP (966 USD) worth of savings. Savings are seeing growth in the future, cumulatively reaching 89k PHP by the end of the year.

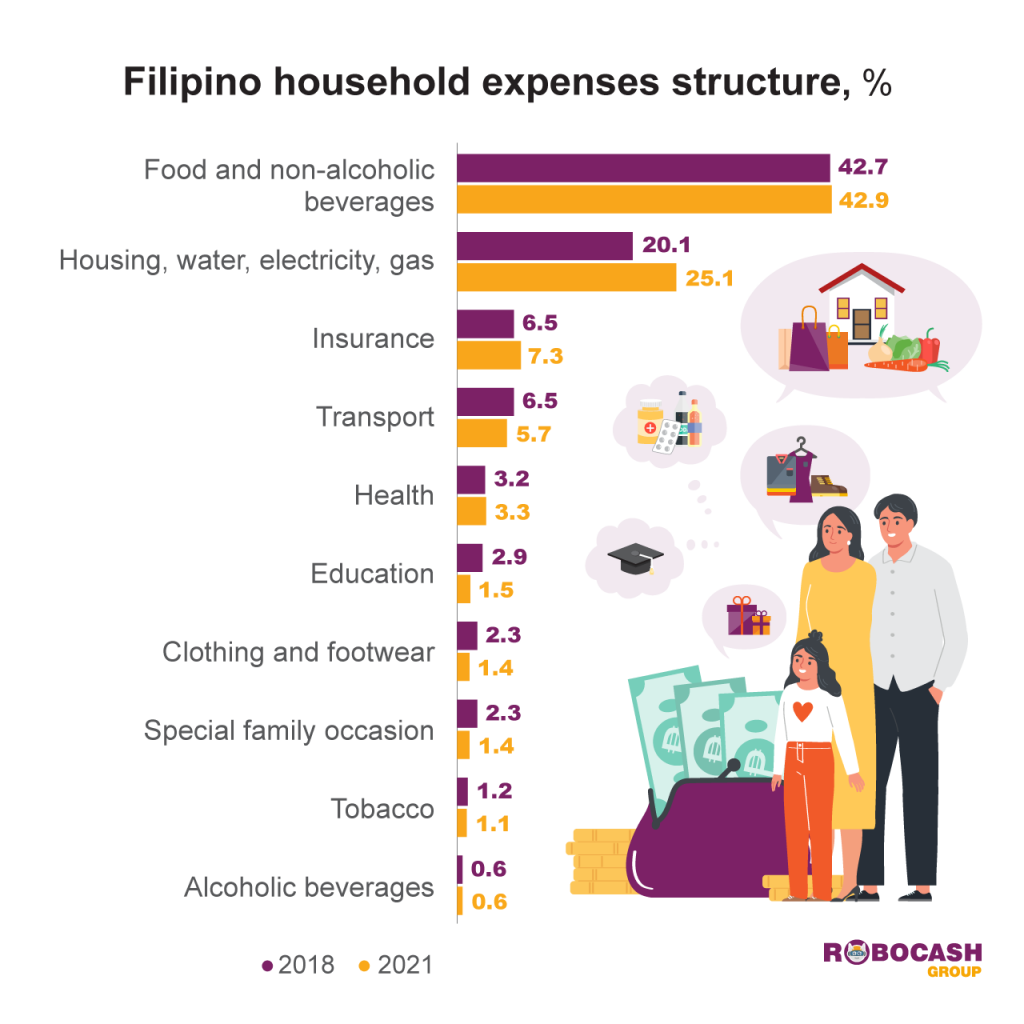

The most significant factor was the recent Covid-19 pandemic. It enforced a more restrained consumption due to mass restrictions and considerable inflation. The latter had surged in annual terms to 8.3% in June 2021. The share of mandatory spending (food, utilities and transport) increased from 69% to 74%.

Another factor is the wealth gap in the Philippines that has narrowed, evidenced by the decrease of the Gini coefficient from 0.46 in 2018 to 0.44 in 2021. The society became more equal, manifested in a more distinct formation of the middle class.

Bank deposits, the most straight-forward way of investing the savings, have seen an increase: to 52% in December 2021, note the analysts. Moreover, digital investing options in the country are becoming more varied. With the Philippine digital banking services gaining in popularity, all this is only the beginning of rapid progress towards the mass digitalisation potential of the population, which promises to flourish full force in the near future.

The forecast is based on the latest triennial report of the Philippine Statistic Authority. The report considers historical data with an identified trend and seasonality, without taking into account both the unforeseen economic shocks and the positive trends.