The analysts at UnaFinancial, a global fintech holding, surveyed current client experience with digital consumer lending services. With the satisfaction rate of the audience being high, the customers are ready to comprehensively master digital finance.

The current satisfaction of the survey respondents is very high. 87% said they were definitely/likely satisfied with digital lending services. Half of the customers already use instant transfers, with nearly half using digital bank accounts.

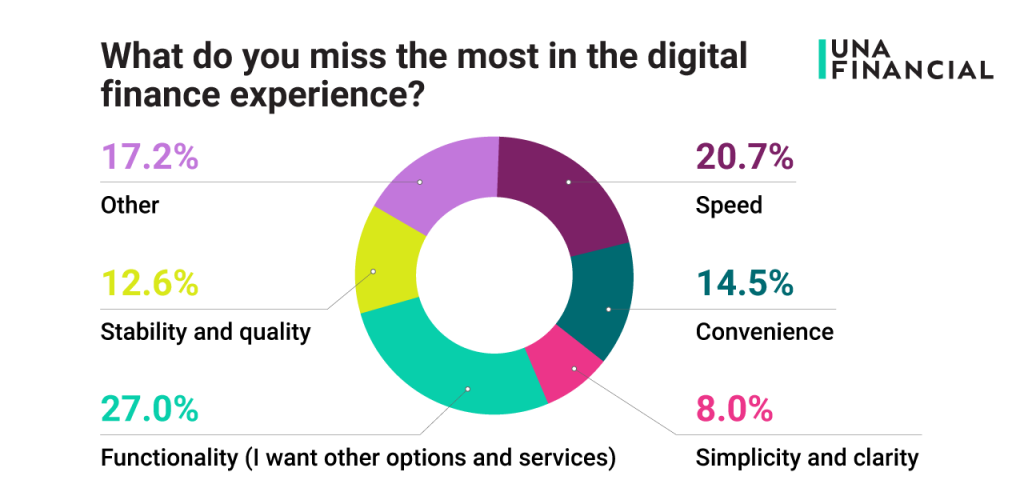

However, the current level of online financial services penetration is not sufficient, according to respondents, and they want to extend their digital financial experience. When choosing the aspects that borrowers are most lacking today, “functionality” topped the list (27%).

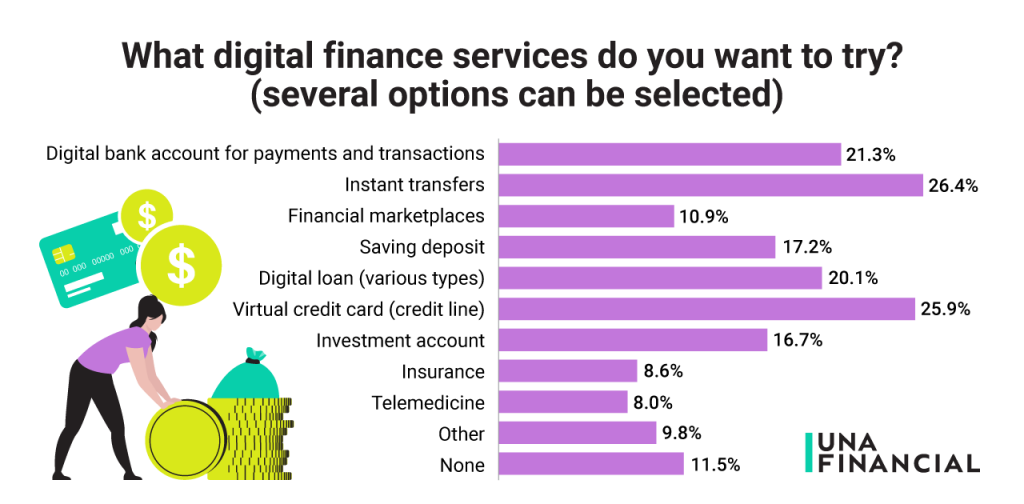

When asked what digital financial services respondents would like to integrate into their lives and use more effectively, 26% identified instant bank transfers and 26% chose virtual credit cards. Almost three-quarters of respondents indicated that they were prepared to fully utilize digital financial services only.

Analysts at UnaFinancial added: “The most commonly selected services from the survey are already included in the digital banking functionality. Notably, between 8% and 11% of the survey respondents said that they want to try all the suggested options – investments, telemedicine, insurance, etc. The large number of respondents interested in online financial services can be viewed as an indicator of customers’ willingness to move to digital proficiency.”

Respondents to the survey are digital consumer lending users in the Philippines.