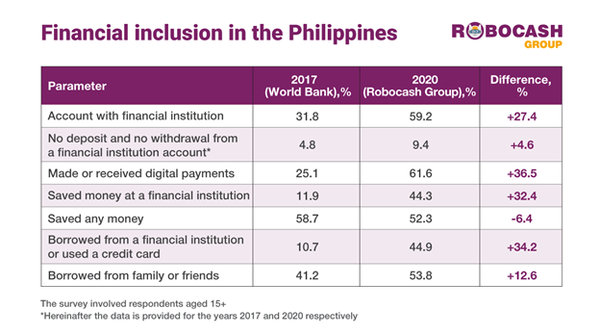

As revealed in a survey by a global fintech holding Robocash Group, the financial inclusion in the Philippines has grown considerably over the past three years. Its main driver is online services, which is confirmed by a 2.5-increase in digital payments between 2017 and 2020.

The latest data on financial inclusion in the Philippines was published in the World Bank’s Findex and refers to 2017. Robocash Group has conducted its own survey asking Filipinos the same questions to estimate how the level of financial inclusion in the country has changed by 2020.

The results confirm that it has significantly increased over the past three years. In particular, the share of respondents who have an account with financial institutions has grown 1.9 times; who saved money at a financial institution — 3.7 times; who used credits and loans — 4.2 times; who made digital payments — 2.5 times.

Such a growth confirms the fast evolution of financial culture in the country. This is especially evident looking at the share of savings. While the share of respondents saving money has remained nearly unchanged since 2017, this year, most of them make savings at financial institutions.

Given the geographic location and the large share of the rural population (52.8% in 2019) in the Philippines, the main driver of financial inclusion in the country is digital financial services. This is also confirmed by a 2.5-fold increase in online payments. Another indirect argument is the growing demand for borrowings. According to the data of BSP, the issuance of bank credit cards in the country went up only 1.5 times and bank consumer loans – 1.3 times in 2018-2019. This suggests that alternative lenders account for a significant share of the 4.2-fold increase among borrowers mentioned above. The alternative lenders provide short-term loans to a big share of the population and as a rule, operate online.

In total, Robocash Group’s survey involved 801 respondents from the Philippines aged 15 or older.

ABOUT

Robocash Group is a group of companies, which provides fintech services in Asia and Europe. Founded by entrepreneur Sergey Sedov in 2013, the group focuses on micro-consumer lending and marketplace funding. All products of the group are built completely in-house using artificial intelligence, machine learning and data-driven technologies to provide precise and comprehensive risk management, comfort and speed for customers and efficiency for business. For the time of operation, the group has gained more than 11 million customers and provided financing in the amount of 800 million USD.