New SSS Contribution Rate Schedule can be found below.

The Social Security System (SSS) will implement a 0.6-percent increase in its current 10.4-percent monthly contribution rate, setting the new rate at 11 percent effective the applicable month of January 2014, as well as the increase in the maximum monthly salary credit (MSC) from P15,000 to P16,000 after it was approved by President Benigno Aquino III. This was disclosed by SSS President and Chief Executive Officer Emilio S. de Quiros, Jr. in a press conference.

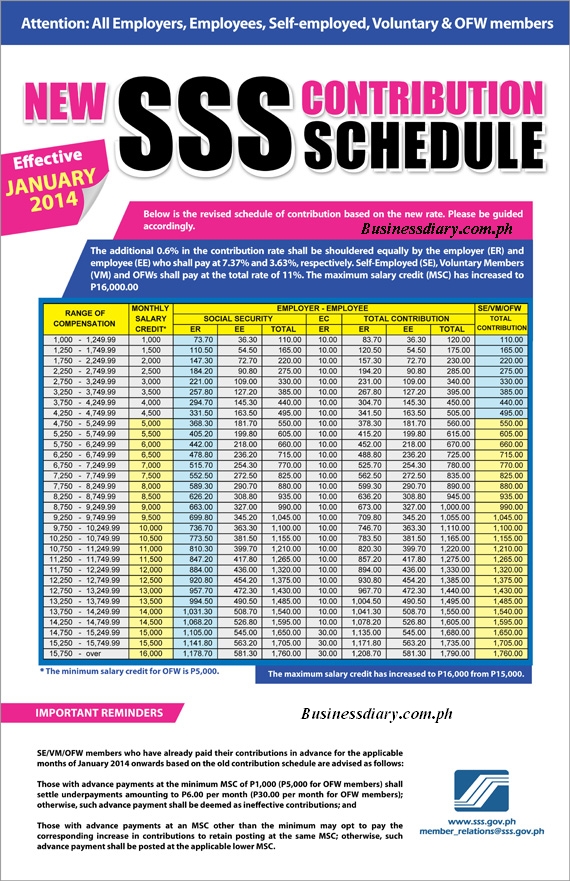

“The 0.6 percent increase will be divided equally between employees and employers, with the latter to pay 7.37 percent, while the former will pay 3.63 percent based on the applicable monthly salary credit (MSC). Self-Employed and Voluntary Members will shoulder the entire 11-percent contribution rate,” de Quiros said.

“This contribution rate increase is part of the SSS Reform Agenda that seeks to lengthen gradually the actuarial life of the Social Security Fund,” he added. “It also aims to reduce the unfunded liability of SSS, which was at P1.07 Trillion as of December 2011 and increases by about eight percent annually.”

An unfunded liability exists when the present value of a pension fund’s contributions and assets is insufficient to cover the present value of future benefit payments and operating expenses. Such situation occurs because the benefits that a member receives or is entitled to far outweigh the accumulated contributions, including interest.

“Increasing the contribution rate would result in bridging the gap between contributions and benefits,” de Quiros added. “In absolute terms, the 0.6 percent increase translates into an additional monthly contribution of P6.00 for every P1,000 increment in the MSC.”

Aside from the 0.6 percent increase in the contribution rate, President Aquino also approved an increase in SSS’ maximum MSC from P15,000 to P16,000. The MSC is the compensation base that determines both the amount of monthly contributions to be paid by the member and the amount of benefits to be derived. With the 11-percent contribution rate, the monthly contribution will be P110 for the minimum MSC of P1,000, P550 for the minimum MSC of P5,000 for OFWs, and P1,760 for the maximum MSC of P16,000.

“The new maximum MSC at P16,000 means that a greater portion of the members’ incomes are covered in their SSS contributions,” de Quiros explained. “Higher contributions eventually mean higher benefits in the future.”

For the past three years, the SSS has been conducting consultation meetings with various stakeholder groups, including employer and worker organizations, to generate understanding and support for its proposed reforms. During his State of the Nation Address before Congress in July, President Aquino declared his support for the need to increase the SSS contribution rate to help address the growth of its unfunded liabilities.

As affirmed by SSC Resolution No. 711-s.2013 dated 20 September 2013, the 11 percent SSS contribution rate and the P16,000 maximum MSC will become effective for the applicable month of January 2014.